Unleashing Brazil’s igaming Potential

Uplatform provides a comprehensive overview of the present status of the industry in the country.

Press release.- Due to technological advancements, increased internet access, and changing regulatory frameworks, Brazil’s igaming industry has seen phenomenal growth in recent years. With a population exceeding 200 million and a deep passion for sports, especially football, Brazil presents a massive market for the igaming sector.

This editorial by Uplatform aims to provide a comprehensive overview of the present status of igaming in Brazil, highlighting the opportunities and challenges it brings forth.

Market potential and growth

Brazil’s demographic profile and rising penetration of smartphones and the internet have propelled the igaming industry’s growth. A tech-savvy, young population has embraced digital platforms for leisure and entertainment, creating a substantial base of potential users for igaming operators.

Exciting developments are on the horizon for Brazil, as the country is on the verge of introducing new regulations in the igaming industry. These upcoming regulations have become the focal point of conference discussions and deliberations, reflecting their anticipated significant impact on the igaming landscape.

Key statics

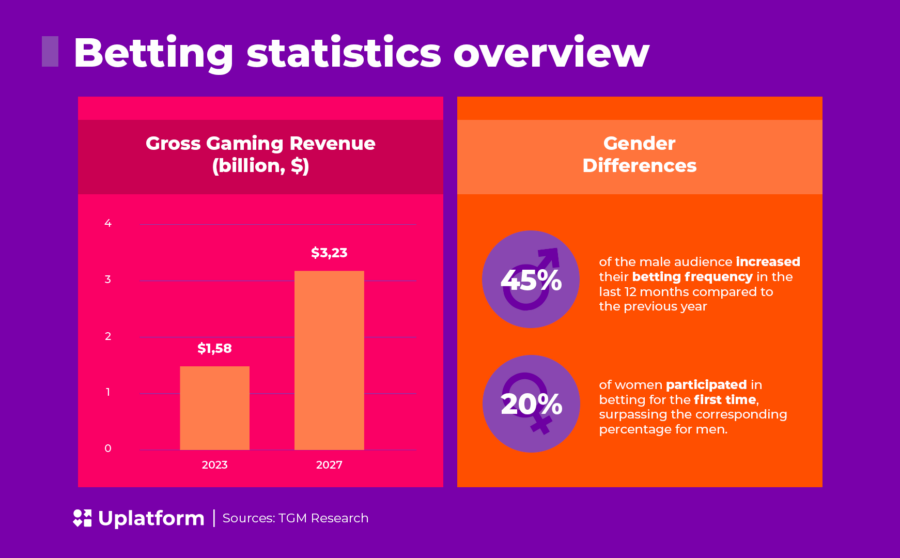

Estimated GGR: The Brazilian iGaming market’s estimated Gross Gaming Revenue (GGR) is projected to reach $1.58bn in 2023 and soar to $3.2bn by 2027. These figures highlight the substantial growth opportunities within Brazil’s iGaming sector.

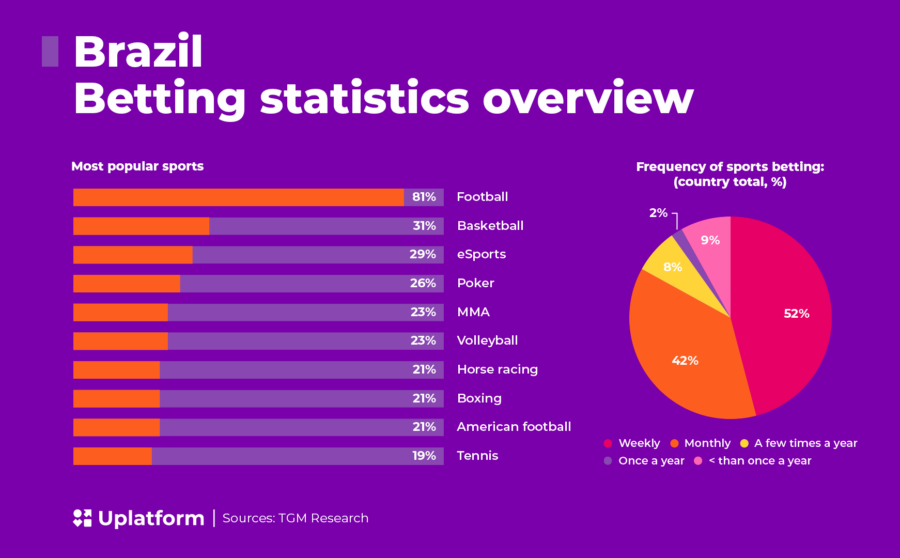

Sports Betting Participation: As per the results of the TGM Sports Betting Survey conducted in October 2022, 46.14 per cent of the Brazilian population engaged in sports betting activities in the previous 12 months. Among the active segments, the 25-34 age group emerged as the most avid participants.

Gender Differences: Interestingly, while 45 per cent of the male audience increased their betting frequency in the last 12 months compared to the previous year, 20 per cent of women participated in betting for the first time, surpassing the corresponding percentage for men.

Popular Sports for Betting: Football retains its position as the most popular sport for betting in Brazil, attracting 81 per cent of the audience. It is followed by basketball with 33 per cent; surprisingly, Esports holds a significant share of 29 per cent in the audience’s preferences.

Brazil’s exceptional size and significance bestow a unique position within the iGaming landscape. As the largest economy in Latin America, the regulatory decisions made by Brazil’s leadership can reshape how other countries approach their own iGaming legislation. Brazil’s approach and regulatory framework could be a powerful example, influencing and guiding other nations as they navigate the path to regulating the dynamic iGaming industry.

Sports betting trends

The sports betting landscape in Brazil stands out for its diversity, with European and American sports capturing the attention of bettors. The demand for attractive and original proposals beyond traditional offerings has increased significantly, with live betting gaining substantial popularity. Sports enthusiasts now have many options to explore and select the wagers that resonate with them the most. For the younger generation, Esports has become an integral part of their betting experience.

Preference for online casino

Regarding online casinos, Brazilian players notably prefer slot machines and live casino games. Additionally, the emergence of the middle class has contributed to the growth of the igaming industry. With rising disposable incomes, more individuals can afford to participate in online gambling and betting activities, seeking entertainment options beyond traditional forms of betting.

Impact of Esports

The popularity of Esports has skyrocketed in Brazil, leading to the convergence of operators and Esports betting. The presence of prominent Dota 2 teams, League of Legends teams, and Counter-Strike: Global Offensive (CS:GO) teams in the LatAm area highlights the region’s significance in Esports. As local groups continue to flourish, the increasing popularity and number of tournaments emphasize the undeniable potential of LatAm, especially Brazil, as a market that demands attention and should be noticed.

Betting operators have to consider this trend in the future, offering betting options for Esports events. This synergy will create a thriving environment that appeals to a younger demographic and fuels the industry’s growth.

Uplatform is proud to present a comprehensive platform tailored to address the diverse needs of operators in Brazil and other emerging markets, notably LatAm. Their platform is designed to tackle the complexities of venturing into these regions, covering retail, infrastructure, and payments.

In these dynamic markets, they understand the challenges businesses face due to low internet and technology penetration. That’s why their solutions cater to both online and offline scenarios, providing valuable assistance in navigating these hurdles.

One of their key strengths is their commitment to linguistic diversity. Uplatform ensures that their platform accommodates diverse linguistic preferences, offering mobile-friendly interfaces and customized content in LatAm Spanish, Brazilian Portuguese, English, and Dutch.

Uplatform recognizes the significance of catering to local preferences, especially when it comes to payments. To facilitate seamless transactions, they offer a wide array of payment options, including eWallets, mobile payments, cash, e-currency exchanges, payment systems, cryptocurrencies, and eVouchers.

Furthermore, Uplatform is fully equipped to cater to Brazil’s burgeoning Esports market. They understand the region’s increasing demands and are ready to provide tailored solutions to meet the unique needs of this growing industry.

Regulatory landscape

Brazil, often referred to as the “Sleeping Giant” of Latin America, has been gradually awakening its potential in the iGaming industry. While igaming was previously prohibited, a specialized commission was established in 2016 to develop guidelines and regulations for the sports betting sector.

In 2018, a law was passed, allowing betting companies to operate in Brazil, leading to a rapid rise in popularity. However, concerns have been raised about loose regulations, prompting the government to devise a plan requiring betting companies to be headquartered within Brazil’s borders for better oversight, taxation, and communication with stakeholders.

With the implementation of new gambling laws, Brazil is poised to become the largest land-based and online sports betting market in South America. Boasting a massive population of over 200 million people, with an estimated 63 per cent having access to mobile technology, the country offers an attractive landscape for sportsbook operators looking to expand into the region.

Brazil’s nationwide passion for sports, especially football, makes it a paradise for sports betting enthusiasts. The projected growth of the sports betting market to over $1bn within five years of regulation opens tremendous opportunities for investment and growth in this exciting industry. President Luiz Inácio Lula da Silva’s signing of the Provisional Measure is a significant step towards realizing this potential. In Rio de Janeiro, Loterj has already issued a sports betting contract to Rede Loto, with other companies looking to secure licenses in the state.

Conclusion

Brazil’s igaming industry holds tremendous promise, with a young, tech-savvy population and an insatiable passion for sports. The combination of sports betting, casino gaming, and the growing influence of Esports creates a dynamic and lucrative market for operators. However, navigating the complex regulatory landscape and market dynamics requires expert assistance.

For operators seeking to tap into Brazil’s burgeoning igaming market, Uplatform offers tailored solutions to establish and expand their online casino or sportsbook operations. With a focus on meeting the distinct requirements of the Brazilian market, Uplatform’s expertise and cutting-edge technology can help operators succeed in the region’s thriving igaming industry.

See also: A cross-cultural study by Uplatform: Bettors’ behaviour in different regions