Atlaslive explores: Why South America is the future of iGaming

Atlaslive analyses the iGaming market in the region.

Press release.- “South America as a part of the LatAm iGaming market is fantastic for building a successful business”, stated Atlaslive, a firm that helps iGaming operators thrive by offering iGaming solutions. Its innovative platform and comprehensive suite of components are developed to meet local regulatory standards, both in South America and globally.

In South America, several factors have fueled the rise of iGaming. According to the firm, the ease and availability of platforms allow people to play various games and place bets from home with just a few clicks. The growth of mobile devices has also made it easier to gamble on the move.

Market trends have been vital, too, especially the growing popularity of online sports betting. As more people in the region tune into sports events and competitions, more are betting on their favorite teams and players. The boost from legal changes that have made online gambling more regulated and safer in many South American countries has also helped the industry flourish.

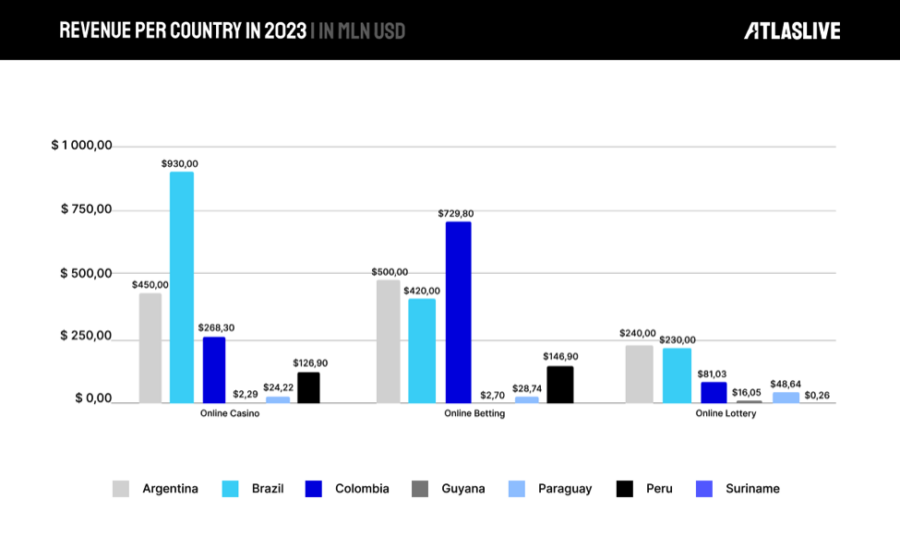

The online gambling market is poised for significant growth, with the number of users projected to reach 10.4 million by 2028. Leading the charge in South America’s iGaming landscape are Argentina, Brazil, Colombia, Guyana, Paraguay, and Peru, which represent the largest markets by revenue. User penetration in the online gambling sector is anticipated to hit 2.1% in 2024, highlighting the increasing acceptance and popularity of iGaming across the region.

South America boasts diverse customs, but the people who live here share a common love for fun. They are cheerful, energetic, and tech-savvy, always seeking ways to enjoy life. iGaming provides a perfect blend of digital entertainment and social interaction, allowing people to have fun whenever and wherever they want.

This dynamic environment is drawing significant interest from players and operators alike, particularly in the rapidly expanding South American market, especially in LatAm. Here’s why everyone is eager to tap into this booming industry.

Explosive growth: iGaming market and key game choice preferences

The user penetration in South America in the online gambling market will be at 2.1% in 2024. This figure highlights the potential for significant market expansion as more users discover and participate in online gaming.

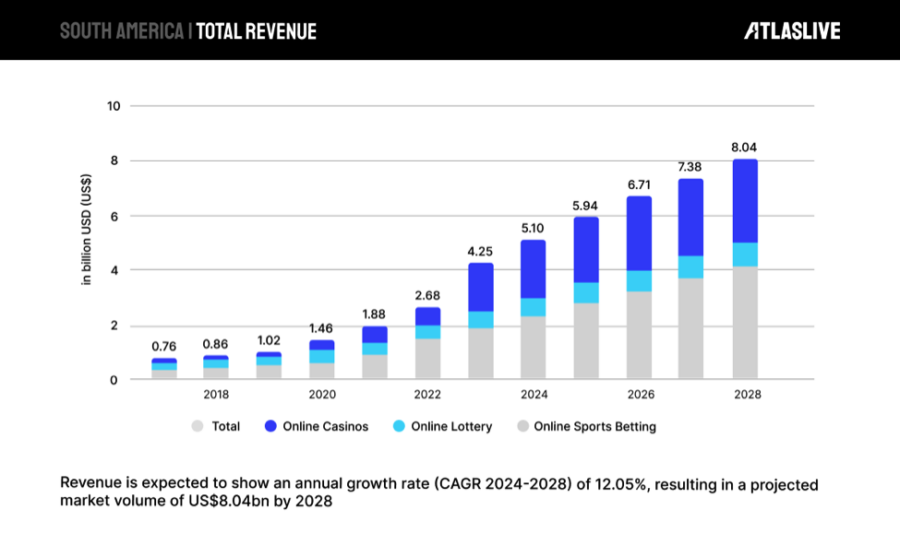

The graph illustrates a consistent upward trend in revenue from online gambling sectors across South America, with online sports betting showing significant growth. By 2028, the total revenue for online gambling is expected to surpass $8bn, driven primarily by the expansion of online sports betting, which increasingly attracts a larger share of the market.

Sports betting is rapidly gaining popularity, driven by the nation’s love for football. Online gambling platforms have tapped into this enthusiasm by offering extensive sports betting options, especially for major football leagues and tournaments, which has significantly boosted market growth. Additionally, online casinos are starting to attract more players, even though sports betting remains the most popular segment.

The graph below offers a detailed look at the 2023 revenue distribution across different segments of the online gambling industry in several South American countries, emphasizing the substantial impact of online casinos and sports betting.

eSports are gaining significant popularity, especially in Brazil. This was evident in the 2022 IEM Rio tournament, where Brazilian teams FURIA Esports, 00 Nation, and Imperial Esports competed against international teams in front of enthusiastic fans at Jeunesse Arena, reaching a peak viewership of 1.4 million.

Despite Brazil having top players and dedicated fans, the government has historically not supported esports. Former sports minister Ana Moser categorized esports as entertainment rather than a competitive sport, excluding it from the General Sports Betting Law’s definition of sports. However, this might change soon, and betting on such tournaments could become possible.

South America: The Average Revenue Per User (ARPU)

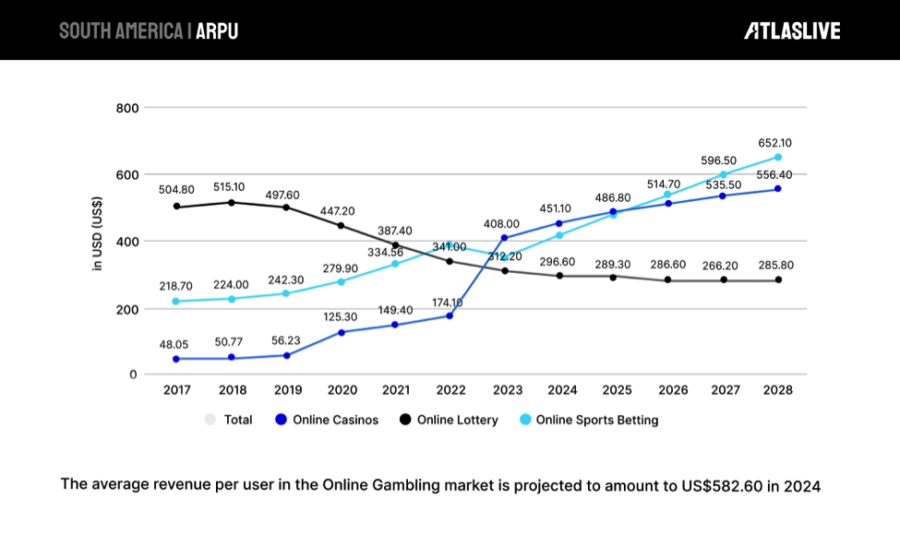

The Statista graph illustrates that the average revenue per user (ARPU) for various online gambling sectors is experiencing notable changes from 2017 to 2028. The online casino sector shows significant growth, with ARPU increasing from $48.05 in 2017 to a projected $556.40 in 2028. In contrast, online lottery ARPU is steadily declining, dropping from $504.80 in 2017 to $285.80 by 2028.

Online sports betting exhibits a steady rise, reaching $652.10 by 2028, surpassing online casinos and lotteries. This trend shows the shifting preferences towards sports betting and online casinos in the market.

All these figures show that South America’s dynamic and evolving market presents vast opportunities for those looking to invest in and capitalize on the iGaming industry. There is also a growing demand for new technologies and innovative solutions that will boost player experiences, offering more opportunities and fun. Embracing these advancements is key to satisfying the tech-savvy, entertainment-seeking South American audience.

Not by sportsbetting alone, or why Crash Games are so popular in South America

Crash games are increasingly popular due to their simplicity, fast-paced nature, and the level of control they offer, unlike traditional slots. These games consistently rank among the top choices in the South American market. At Atlaslive, they recognize that a diverse player base requires a wide variety of games to cater to different tastes, which is why it ensures its platform includes a rich assortment of popular titles.

Atlaslive stated that it continues to partner with many new globally recognized game providers, and currently, its casino games portfolio is outstanding in terms of variety of games, visual appeal, and diverse bonuses and perks. “We already offer more than 10,000 online casino games, live games, virtual sports, lotteries, and tournaments all in one place. We see how many players in South America are engaged in playing crash games, slots, and roulette, and we are doing everything to meet the needs of our partners by providing all the exciting games their customers desire. At the moment Atlaslive Platform includes more than 100 crash games, including all popular ones,” the company said.

A variety of regulatory frameworks in South American iGaming market

At Atlaslive, they closely monitor the diverse and changing regulatory landscapes of the South American iGaming market. Each country has its own legal requirements and compliance standards that shape the opportunities and challenges for operators. Understanding the specific needs of our partners in these regions is crucial.

Brazil, Colombia

Brazil made notable improvements in its regulatory structure. In December 2023, the signing of Bill 3,626/2023 into law marked the legalization of online sports betting and casino games. This monumental change opens up one of Latin America’s largest economies to regulated iGaming, offering tremendous growth potential for the industry. The firm, as a B2B iGaming platform provider, understands how important it is to fulfill the high demand and regulatory standards set by this new legislation.

Colombia stands out as a pioneer in gambling regulation within Latin America. Since 2016, the country’s regulatory body, Coljuegos, has been overseeing the industry with a strong emphasis on compliance and responsible gambling practices. Colombia’s well-established regulatory framework ensures a robust structure for licensing and compliance, making it a stable market for operators.

See also: Atlaslive shortlisted as “Rising Star in Sports Betting Innovation” at the SBC Awards 2024

Argentina, Peru, and Chile

Argentina presents a unique scenario with its decentralized approach to gambling regulation. The regulations vary significantly from one province to another, creating a mosaic of rules. This decentralized framework offers both challenges and opportunities for operators aiming to expand their presence in the market.

Peru is currently in the early stages of establishing its regulatory system for iGaming. The emerging regulations are shaping the future of online gaming in the country, presenting lucrative opportunities for early market entrants to capitalize on the growing demand. The process of finalization is still ongoing but the finish line is within reach and many new operators are already showing interest. The government is working on issuing licenses, and once the framework is fully established, it will allow operators to start their businesses officially.

The Peruvian government has published regulations for online gambling, effective from 2023, allowing MINCETUR to license and regulate online gaming and sports betting. This framework aims to ensure fair play, responsible gaming, and increased government revenue through a 12% tax on net profits from licensed operators. Becoming a fully regulated market is always a long road, and in the case of Peru, it is almost at the destination. Currently, user penetration in the online gambling market is at 2.1% and there is a noticeable increase in interest among Peruvian customers in a diverse range of casino games.

Countries like Chile are gradually shifting towards establishing their online gaming laws. The country has recently introduced licensing regimes for online gambling, following the examples set by Colombia, Mexico, Panama, and certain provinces of Argentina. The Chilean government has been working on comprehensive legislation to regulate online casino games and sports betting. The Ministry of Finance presented a bill that was approved in the first stage.

According to Atlaslive, they are dedicated to continuously enhancing its dynamic iGaming Patform by introducing new features and tools that operators can seamlessly integrate. Its focus spans all aspects of user experience and market needs, from Sportsbook and casino offerings to payment methods, analytics, and efficient CRM. Our strategic and innovative approach ensures that our partners are well-equipped to deliver a safe, secure, and legally compliant gaming experience in Latin America.