AGA reports record commercial gaming revenue of $17.63bn in Q2

The industry contributed more than $37bn in gaming tax revenue. It was the 14th consecutive quarter of growth.

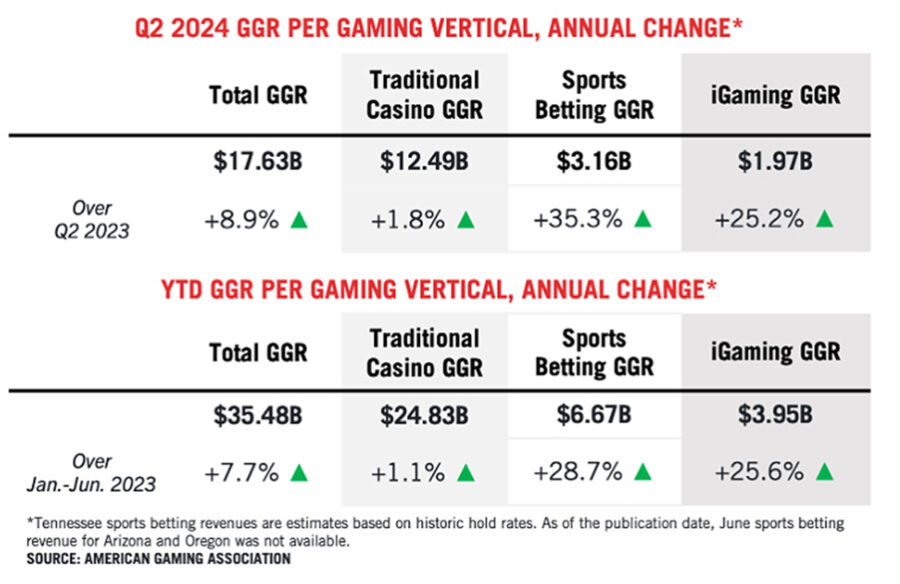

Press release.- The American Gaming Association (AGA) has reported that commercial gaming revenue in the U.S. reached $17.63bn in the second quarter of the year. This marks the industry’s 14th consecutive quarter of increased revenue and its most profitable performance in the second quarter so far.

Across the country, 24 jurisdictions saw year-over-year revenue growth in Q2 2024, and nationwide commercial gaming revenue resulted in $3.73bn in state taxes generated directly from gaming.

Both land-based (including brick-and-mortar sportsbooks) and online gaming saw annual growth for the quarter. Year-over-year, the pace of land-based growth accelerated slightly, and while the pace of online growth improved from the first quarter of 2024, it slowed significantly from nearly 44 per cent in Q2 2023 to 32.5 per cent in Q2 2024. Overall, land-based gaming accounted for 71.4 per cent of total revenue while online gaming represented the remaining 28.6 percent.

Taking a closer look at each major vertical

- Traditional Gaming: Traditional brick-and-mortar casino gaming generated quarterly revenue of $12.49bn (+1.8 per cent year-over-year), with annual revenue gains in May and June buoying a slow beginning to the quarter in April.

- Legal Sports Betting: Americans wagered $31.75bn on sports in Q2 2024, generating $3.16bn in quarterly revenue (+35.3 per cent year-over-year). The growth compared to Q2 2023 was bolstered by new market launches in Kentucky, Maine, North Carolina, and Vermont since last spring.

- iGaming: iGaming grossed $1.97bn in Q2, a 25.2 per cent year-over-year increase. Sequentially, iGaming revenue declined slightly (-0.7 per cent) from Q1 for the second straight year.

AGA vice president of research David Forman said: “While sports betting and iGaming continued to drive overall industry revenue growth in the second quarter, new brick-and-mortar property openings in Illinois, Nebraska and Virginia also led to rising traditional commercial gaming revenue. Across the country, land-based gaming markets are seeing mixed year-over-year comparisons due to slower consumer spending economy-wide, which may continue to be a factor through the remainder of 2024.”

Background

AGA’s Commercial Gaming Revenue Tracker provides state-by-state and cumulative insight into the U.S. commercial gaming industry’s financial performance based on state revenue reports. This issue highlights Q2 2024 results.

37 states and the District of Columbia featured operational commercial gaming markets in Q2 2024, including casino gaming, sports betting and iGaming.

AGA’s State of Play Map charts gaming’s economic impact, industry regulations and casino locations on a state-by-state basis for both the commercial and tribal gaming sectors.

See also: AGA backs legislation on training to combat human trafficking