Genius Sports revenue up 70% for Q3

Genius Sports delivered record high Q3 revenue of $69.1m, growing over 70 per cent year-over-year.

Press release.- Genius Sports, the official data, technology and commercial partner that powers the global ecosystem connecting sports, betting and media, today announced financial results for its fiscal 2021 third quarter ended September 30, 2021.

“Genius Sports’ growth is accelerating at an unprecedented level that far surpasses our original expectations. We are capturing more opportunities than ever before, underpinned by the broad adoption of official data by the entire ecosystem,” said Mark Locke, GSL Co-Founder and CEO. “While only months into our first NFL season, we are even more confident of the long-term prospects of the partnership. We are transforming the global sports betting market through our progressive investment in technological innovation, and we will continue to do so for years ahead.”

Nick Taylor, GSL CFO, added, “We’ve positioned the business for continued success, giving us great confidence in raising our 2021 revenue outlook. We anticipate continued strong revenue growth as the market continues to expand and evolve, while preserving the option to reinvest in the business to fund strategic growth initiatives and drive long-term sustainability and scale. This early stage of our growth cycle presents a window of opportunity to invest in the future success of the business, and we’re excited to continue building towards our strategic vision.”

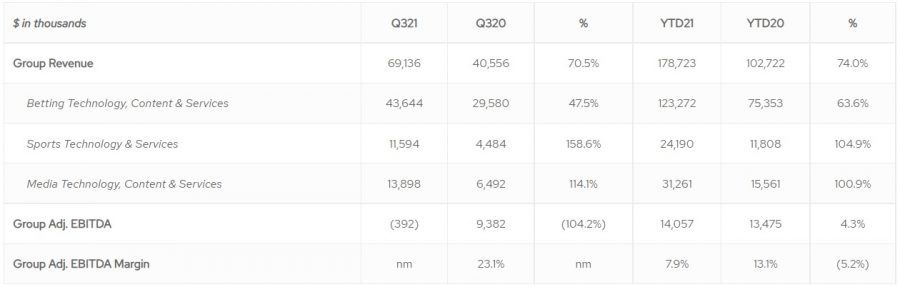

Q3 2021 Financial Highlights

- Group Revenue: Group revenue increased by over 70 per cent year-over-year to $1m, driven by significant, well-balanced growth across all business segments. On a constant currency basis, revenue increased $25.9m, or 60 per cent year-over-year.

- Betting Technology, Content & Services: Revenue increased 48 per cent year-over-year to $43.6m. Growth in the business was driven by price increases on contract renewals and renegotiations with existing customers, powered by our official rights strategy, expansion of value-add services, and new service offerings. Growth was also supported by new customer wins and increased utilization of our available content.

- Sports Technology & Services: Revenue increased 159 per cent year-over-year to $6m, driven by the inclusion of revenues derived from two acquisitions, Sportzcast, acquired in December 2020, and Second Spectrum, acquired in June 2021.

- Media Technology, Content & Services: Revenue increased 114 per cent year-over-year to $9m, driven by new customer wins for programmatic advertising services and inclusion of revenues from recent acquisitions.

- Group Adj. EBITDA: Group adjusted (non-GAAP) EBITDA was ($0.4)m, with revenue growth offset by strategic investments and data rights costs.

Business Highlights

During the third quarter reporting period:

- Announced strategic partnerships to provide our NFL offering to:

- Caesars,

- DraftKings,

- Entain and BetMGM,

- Golden Nugget Online Gaming,

- Penn Interactive to power its Barstool Sportsbook,

- WynnBET, and

- 888 to power its SI Sportsbook

- Granted a Temporary Event Wagering Supplier license by the Arizona Department of Gaming.

- Certified by the State of Connecticut, Department of Consumer Affairs, as an Online Gaming Service Provider.

After the third quarter reporting period:

- Announced a new landmark partnership with Hard Rock Digital and expanded partnerships with FanDuel and PointsBet to provide our NFL offering.

- Announced in-stadia sports betting partnership with the Philadelphia Eagles to deliver real-time betting odds and drive fan engagement in Lincoln Financial Field’s sports betting lounges.

- Second Spectrum appointed the exclusive Official Tracking Data Provider of Danish Superliga and 1st Division, expanding on Genius’ existing league partnership.

- Certified by the State of Louisiana Gaming Control Board as a Sports Wagering Service Provider for an initial six months, making Genius operational in 18 U.S. states.

Financial Outlook

Genius increased its full-year 2021 revenue projections and now expects to generate approximately $257 to $262m (previously $255 to $260m). The company also revised its adjusted EBITDA forecast to be broadly breakeven (previously $10 to $20m), reflecting strategic reinvestment of near-term earnings to fund organic and inorganic growth initiatives supporting long-term sustainability and scale.

Genius management believes the positioning of the business over time will rely on the investments made in this early stage of the Company’s growth cycle, which may present attractive opportunities with sustainable long-term returns. These anticipated investments include various technology developments, data and streaming rights, the expansion of U.S. operational infrastructure, as well as other potential opportunities to help solidify the Company’s competitive advantages, while supporting a stabilized Adj. EBITDA margin of 40 per cent at scale.

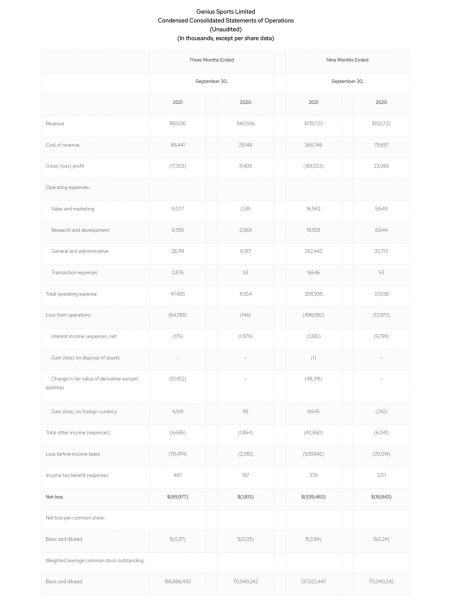

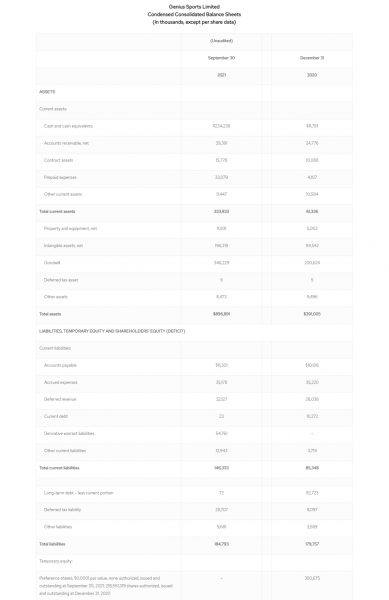

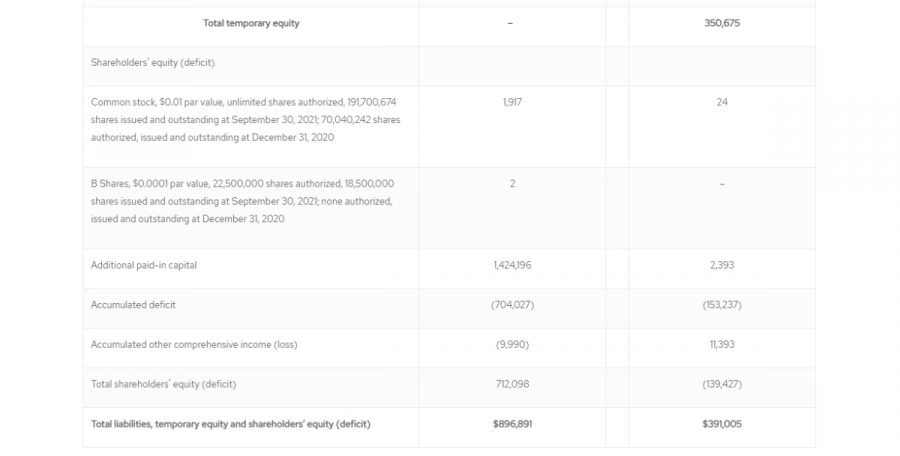

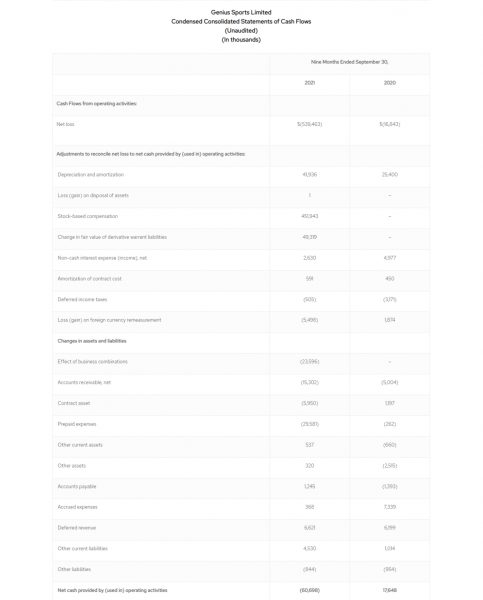

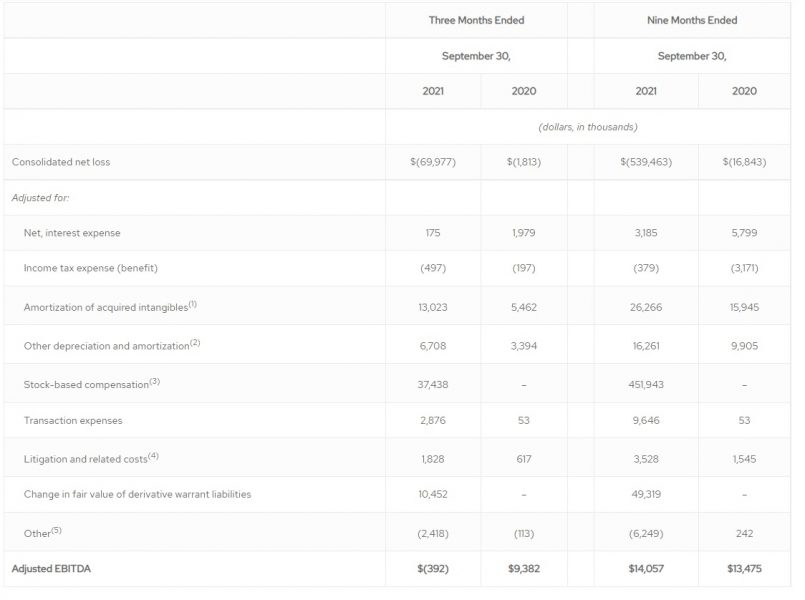

Financial Statements & Reconciliation Tables

Genius Sports Limited

Reconciliation of GAAP Net loss to Adjusted EBITDA

(Unaudited)

(In thousands)

- Includes amortization of intangible assets generated through business acquisitions, inclusive of amortization for data rights, marketing products, and acquired technology.

- Includes depreciation of Genius’ property and equipment, amortization of contract cost, and amortization of internally developed software and other intangible assets. Excludes amortization of intangible assets generated through business acquisitions.

- Includes restricted shares and stock options granted to employees and directors and equity-classified non-employee awards issued to suppliers.

- Includes mainly legal and related costs in connection with non-routine litigation matters including Sportradar litigation and BetConstruct litigation.

- Includes gain/losses on disposal of assets, gain/losses on foreign currency and expenses incurred related to earn-out payments on historical acquisitions.