EvenBet Gaming analysed the most well-known AML/KYC/anti-fraud solutions in the iGaming industry

Evenbet has shared the results of the analysis of KYC services provided by the most well-known technology suppliers in the iGaming industry.

Financial crime risks are growing in iGaming and every year it becomes more important to have tools to reduce risks.

The AML program helps to spot and take precautions to reduce risks. iGaming operators have the responsibility to implement AML controls for new users.

KYC procedures are performed during the customer onboarding process and are required for user ID identification control and risk estimation during account registration.

Due to this situation, Evenbet Gaming made an overview of KYC services provided by the most well-known technology suppliers in the iGaming industry.

“The idea behind this comparison was at first to look for the KYC solutions most suitable for our customers, but after all, we have decided to make it open to help those who are looking for the best service provider,” stated EvenBet Gaming CEO Dmitry Starostenkov.

The pain point is that regulators fine and impose penalties on the businesses which do not meet AML requirements.

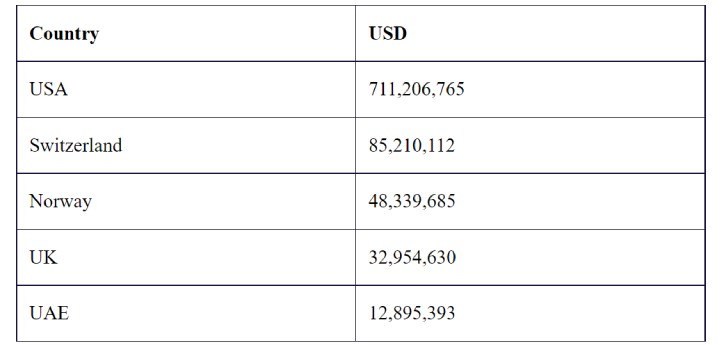

The United States, Switzerland, Norway, the United Kingdom and the United Arab Emirates top Fenegro’s list of 31 countries that had issued most of the fines. The recent report shows how much the following countries accumulated.

EvenBet Gaming has studied more on AML/KYC/anti-fraud solutions the most reputed companies in the market offer. The company comparer used technologies, solutions for a variety of needs, USP, and more, to choose the best one.

Jumio

Jumio provides automated identity verification and AML solutions powered by AI. Cutting-edge AI is the company’s strongest technology along with expertise in various markets. The company has big experience in the field and is a pioneer in selfie-verification.

Features and capabilities

- Jumio ID and identity verification (Face-based biometrics)

- Jumio Go identity verification powered exclusively by AI

- Jumio document verification (Electronic passport support with NFC)

- 2FA authentication

- Jumio address services

- Jumio video verification

- AML solutions: transaction monitoring, screening, and case management

- OCR, Certified liveness detection

Markets

200+ countries

Industries

- Retail

- iGaming

- Financial services

- Telcos

- Sharing economy

- Mobility

- Healthcare

- Travel

- Education

Experience

10+ years

Pricing principles

The company has a TCO calculator to find out how much an online identity verification solution costs. Easy calculation form and all the numbers needed in several clicks.

GBG Group

GBG helps organizations quickly validate and verify customers’ age, identity and location, perform bank account verification, PEPS and sanctions, and fraud detection and prevention. The company’s strongest feature is comprehensive experience and understanding of the iGaming industry, i.e. compliance and markets.

Features and capabilities

- Digital and physical tamper detection

- Active and passive liveness (Biometric and AI-led technology)

- Forensic document experts

- NFC

- Facematch (Biometric and AI-led technology)

- Investigation studio

Markets

24 countries for identity/address verification (Europe, Australia, Asia, North America, South America). PEP & Sanction checks are global.

Industries

- Retail and eCommerce

- iGaming

- Fintech

Experience

30+ years experience in data and technology. Wide experience in the field of iGaming, including a deep understanding of the compliance specifics.

Pricing principles

Not specified

ShuftiPro

Company’s AI-powered Identity Verification Solutions allows verification and authentication of customers in real-time. The company claims to hold a prominent position in the market for the quickest response time of 7-60 seconds with an accuracy rate of 98.67%. Shufti works on a dual-layered mechanism of AI and HI (Human Intelligence). The company has human experts who re-review the verifications in case AI finds any ambiguity before dispatching the verification results.

Features and capabilities

- Optical Character Recognition (OCR) Technology

- Document/address verification

- 2-factor authentication

- Face Recognition/Liveness

- Consent Verification

- AML screening solution

- KYB

- Check Background from 1000+ AML Lists (updated every 14 minutes realtime)

- Biometric Authentication

- Award-Winning Global Video KYC (Live video interviews)

- Possibility of On-Premise solution on demand

Markets

Verification services in 230+ countries and territories

Industries

- Banks

- Financial Institutions

- Real Estate

- eCommerce

- Health Industry

- Insurance

- iGaming

- P2P Economy

Experience

3+ years active

Pricing principles

Customized pricing models, e.g. based on users number and the number of documents required for verification.

Invoid

The company has prior experience in banking, finance and building scalable AI products. Its strongest feature is seamless user onboarding & verification.

Features and capabilities

- Compliant Video Conferencing based KYC

- Digital KYC (Facial + ID Check): ID Card, gesture-less liveness detection & fraud checks on document

- Document Verification

- Document Number Verification

Markets

Not specified

Industries

- Banking

- iGaming

- Education

- Rental platforms

- Financial institutions

Experience

Founded in 2018

Pricing principles

Not specified

Sum&Substance

The company empowers compliance and anti-fraud teams to fight money laundering, terrorist financing, and online fraud. User-friendly design, proven speed of KYC procedures and overall reliability are the key company’s features.

Features and capabilities

- Identity verification and KYC/AML (including PEPs and sanctions)

- KYB – corporate verification

- Video verification

- Document verification

- Liveness technology

- Chargeback prevention

- Cryptoasset transactions monitoring

- Coverage of territories and languages, including Latin, Cyrillic, Arabic, and East Asian scripts.

Markets

Global coverage of documents from 220+ countries

Industries

- Fintech

- Transportation

- Trading

- iGaming

- Marketplaces

Experience

5+ years in business

Pricing principles

The company has rather flexible and adaptable to customers’ needs pricing policies, e.g. number of users.

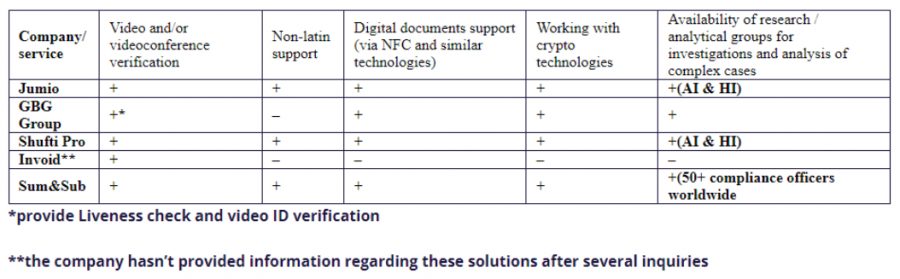

Conclusion

All of the companies above have up-to-date technologies and provide a number of solutions for AML / KYC / anti-fraud procedures. The cost of services in each company is calculated for each customer individually – depending on its needs, regulations, and the market.

Leveraged technologies are rather substantial, but there are nuances in the services. An operator should focus on them, taking into account the needs of their own business. For some operators, these features may be critical, and there are discrepancies on them among providers.

EvenBet Gaming pays special attention to regulatory compliance, so operators have all tools to run the business safely and for their users to pass the KYC procedures with ease.