Atlaslive explores: Argentina’s igaming market doubles penetration by 2028, 4 times outpacing South America

The Atlaslive team has prepared an insightful article that provides an in-depth analysis of Argentina’s igaming market.

Press release.- The igaming market in Argentina is a dynamic and rapidly evolving sector, shaped by cultural preferences, regulatory changes, and technological advancements. Football, a national obsession in Argentina, drives the dominance of sports betting, especially on football matches. Despite this, online casinos continue to set the tone for the entire market, establishing themselves as key players in the industry.

Atlaslive provides an overview of Argentina’s igaming market, based on the fresh Statista data, exploring the market’s current state, trends, and challenges, while also highlighting how Atlaslive’s dynamic igaming platform is perfectly suited to capitalize on these opportunities.

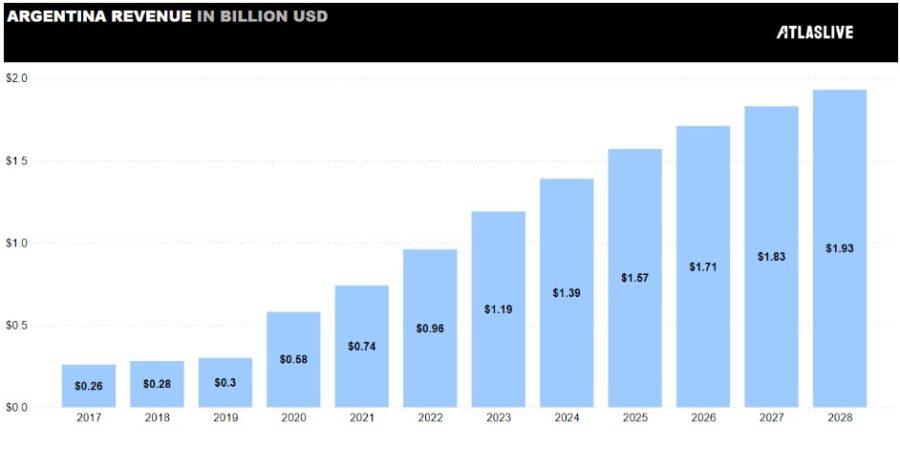

Significant jump: Online market growth and revenue trends

Argentina’s igaming market has demonstrated a robust upward trajectory in revenue generation. The period between 2019 and 2020 demonstrated a significant jump in revenue from $0.3bn to $0.58bn. This surge was largely catalysed by the pandemic.

The Covid-19 pandemic significantly accelerated the adoption of igaming in Argentina, as physical casinos and betting shops were closed, pushing consumers towards online alternatives. It was in 2020 that the online casino category emerged as a result of the pandemic, becoming the main driver of revenue that year.

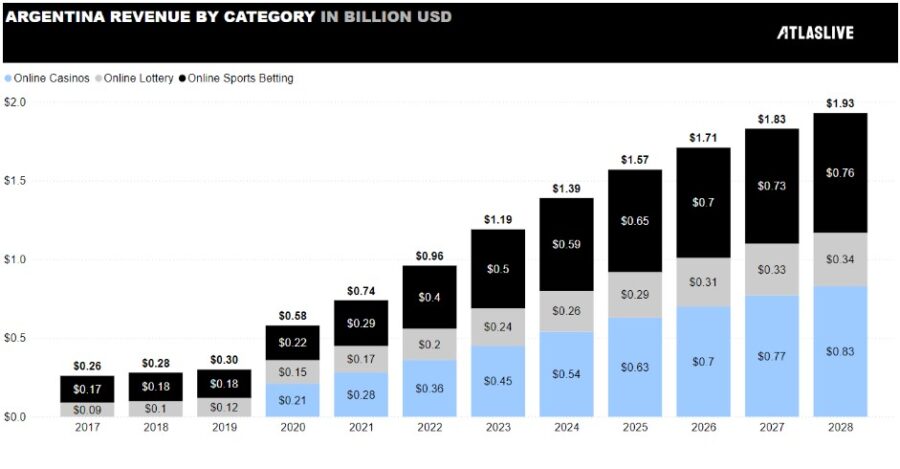

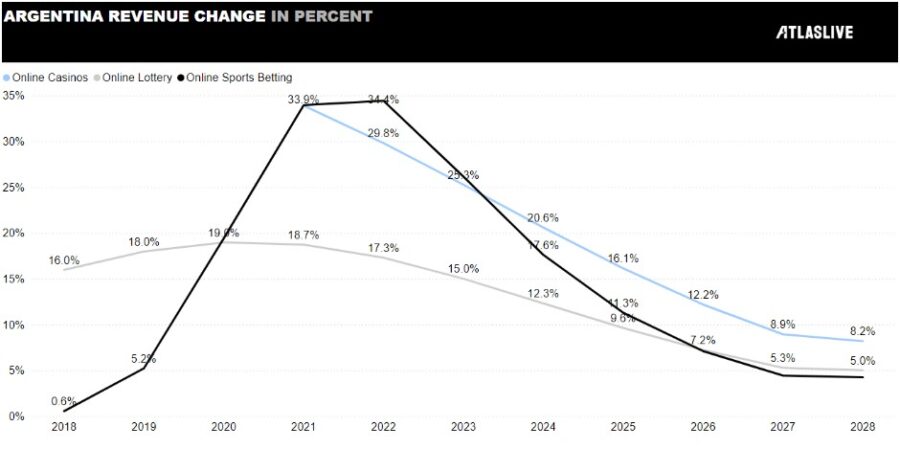

This shift has had a lasting impact, with many users continuing to favour online platforms even after restrictions were lifted. The post-pandemic period has seen continued growth, underscoring the market’s resilience and long-term potential. We see a strong growth trend across all categories, with Online Sports Betting and Online Casinos showing the most substantial increases. The data suggests that while Online Lottery grows steadily, Online Sports Betting and Online Casinos are the primary drivers of revenue growth in Argentina’s Online Gambling market from 2017 to 2028.

In the 2017 -2019 period, the revenue from igaming in Argentina was distributed between two categories: Online Lottery and Online Sports Betting. Compared to 2018 Online Lottery contributed 100 per cent to revenue growth.

In 2020 Online Casinos entered the market and at the end of the year, it contributed more than 77 per cent in revenue growth and began to gain more and more popularity in the Argentina market. It is expected that from 2026, the share of the contribution to revenue growth from Online Casinos will be more than 53 per cent and will gradually grow in subsequent years.

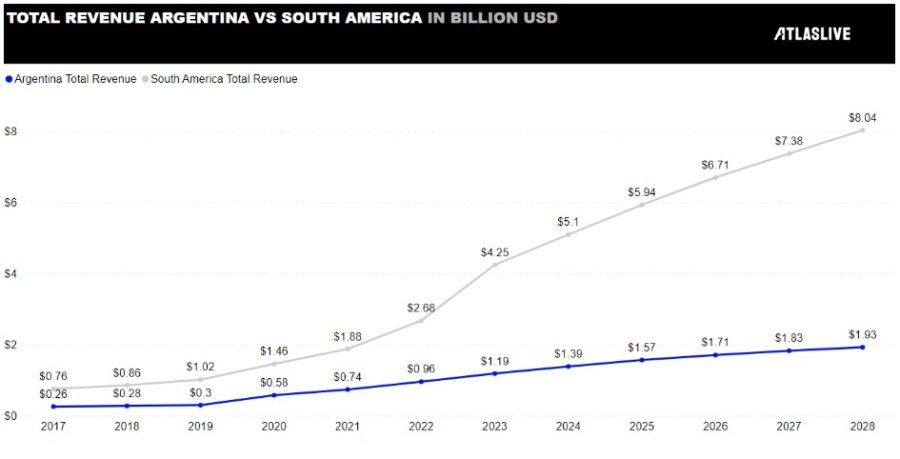

Steady growth and market share within South America

Despite its impressive growth, Argentina’s igaming market is not expanding as rapidly as the broader South American region. This discrepancy signals untapped opportunities that could be exploited by adopting more proactive growth strategies.

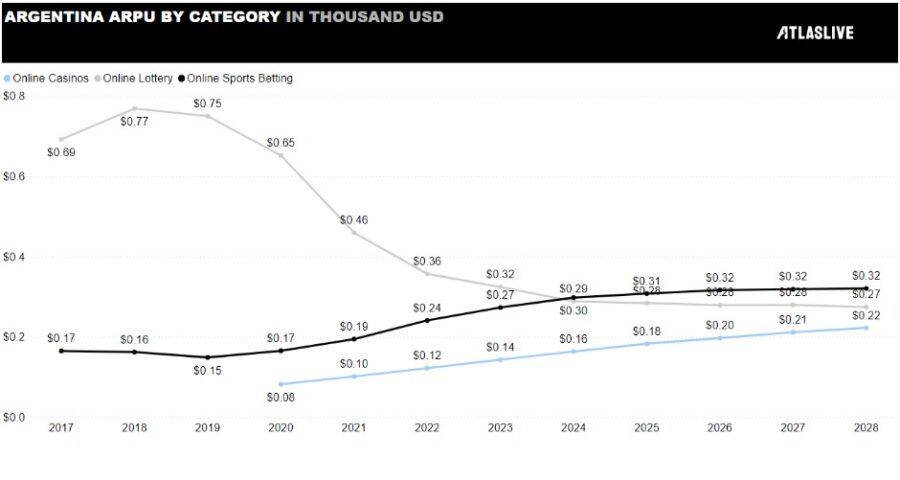

ARPU trends highlight the shifting dynamics within the market. Online Sports Betting is steadily increasing in ARPU, signalling its rising popularity and potential for sustainable growth. Online Casino is also on a positive growth path in terms of ARPU, although it starts from a lower base. Online Lottery’s ARPU peaked in 2018-2019 and then declined, indicating potential market saturation or changes in user behaviour.

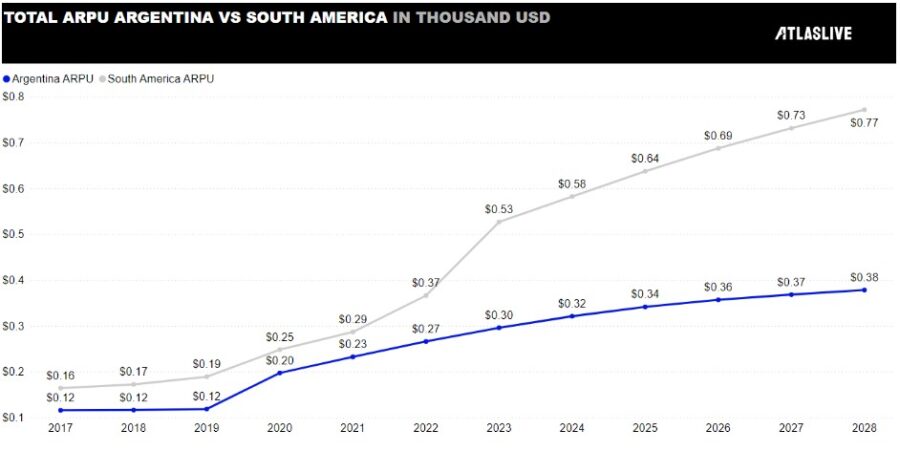

The chart highlights that while Argentina is experiencing steady growth in ARPU, it is not keeping pace with the broader South American market, where ARPU is increasing more rapidly. Here we can see that not only are the growth rates lagging, but the absolute figures are also 45 per cent lower in 2024, this is something to watch out for.

We observe that the percentage gap between Argentina’s ARPU and the South American region has been widening since 2023. Growth in revenue in Argentina has slowed, particularly after 2022, indicating that the market may be approaching a saturation point and will soon require new strategies to stimulate both the market and player engagement.

This suggests that while Argentina’s market is improving, there are potentially untapped opportunities or strategies that could further boost revenue per user, bringing it closer to the regional average.

Football and convenience: Customer preferences and market trends

Argentinian consumers are increasingly turning to igaming due to its convenience, accessibility, and the wide variety of options available. The proliferation of smartphones and improved internet infrastructure have been pivotal in this shift, with mobile gaming emerging as a dominant force. This trend is in line with global developments, where consumers prefer the flexibility and on-the-go accessibility offered by mobile platforms.

Sports betting, especially football, remains a significant draw for Argentine gamblers. The cultural passion for football has made sports betting one of the most popular forms of igaming, and this segment continues to grow as more operators introduce sophisticated and engaging betting features.

Player base expansion and market penetration

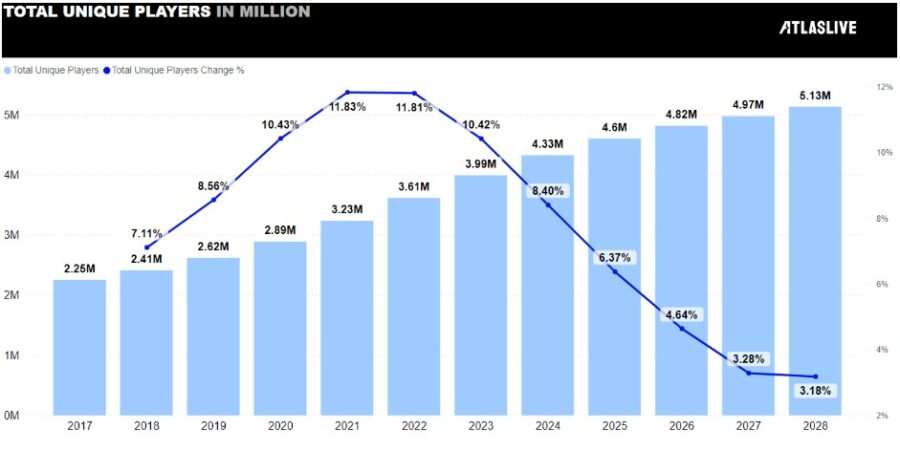

From 2017 to 2023, the total number of unique players steadily increased each year. Starting at 2.25 million in 2017, the figure rose to 3.99 million by 2023. The most significant growth occurred between 2019 and 2021, where the percentage change in unique players was over 10 per cent annually, peaking at 11.83 per cent in 2021.

Starting in 2024, the growth rate began to decline sharply, from 8.40 per cent in 2024 to 3.18 per cent in 2028. Although the absolute number of players continued to grow, reaching 5.13 million by 2028, the pace of growth slowed considerably. For instance, between 2023 and 2024, the growth rate dropped to 8.40 per cent, followed by further declines in subsequent years. The consistent decline in growth rates, especially the drop to 3.18 per cent in 2028, suggests that the market may be nearing saturation, with fewer new unique players being added each year.

The period from 2017 to 2021 was marked by strong and accelerating growth, indicating a phase of rapid market expansion. The subsequent decline in growth rates, particularly from 2024 onwards, points to a maturing market where the influx of new players is slowing down. Despite reaching over 5 million unique players by 2028, the declining growth rate suggests challenges in sustaining high growth levels.

To maintain or accelerate growth, strategies may need to be adjusted. This could involve exploring new markets, enhancing player retention strategies, or innovating the product offering to attract a broader audience.

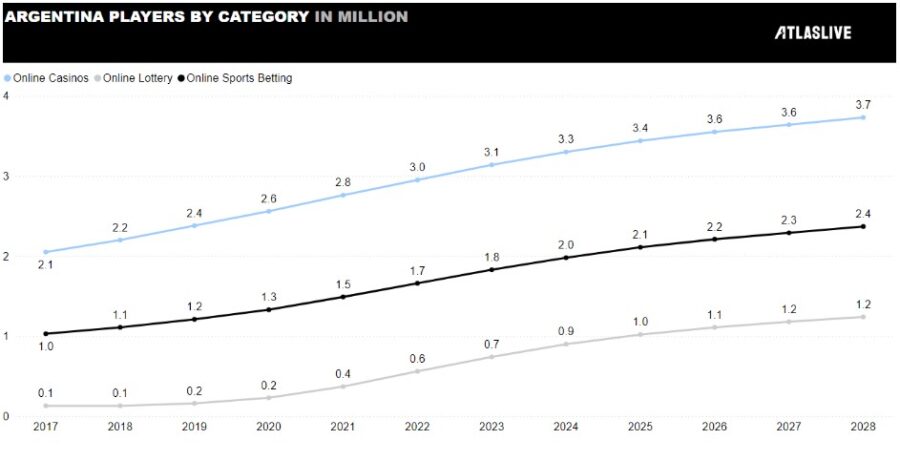

Simultaneously, the igaming market in Argentina continues to expand, with all three categories experiencing positive growth in player numbers. Online casinos remain the most popular, boasting a significant and steadily growing player base.

Online Sports Betting is also on a strong upward trajectory, indicating rising interest and market penetration. The Online Lottery, while smaller in scale, continues to attract players each year, showing steady growth. These trends suggest a healthy and expanding igaming market in Argentina across all categories.

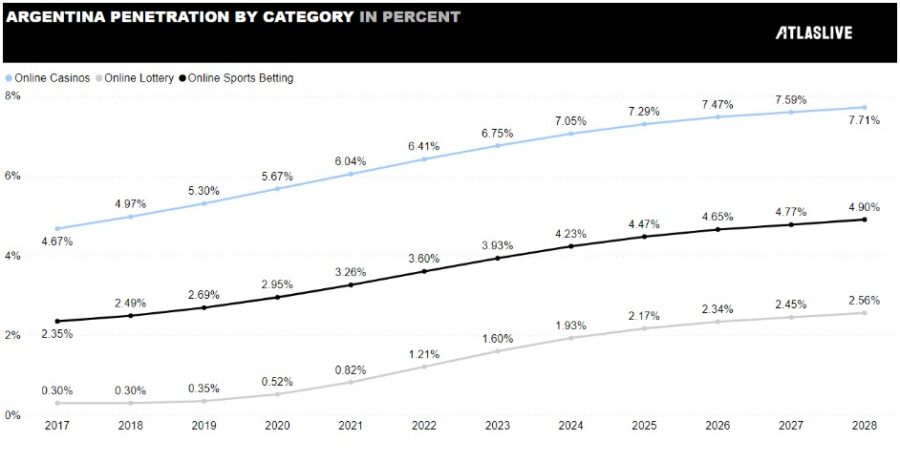

The chart highlights the expanding reach of igaming categories in Argentina. Online Casinos lead in market penetration, followed by Online Sports Betting, which is catching up rapidly. The Online Lottery, while still the smallest category, demonstrates steady growth in penetration.

These trends suggest a broadening adoption of igaming across the population, with all categories showing positive dynamics over time.

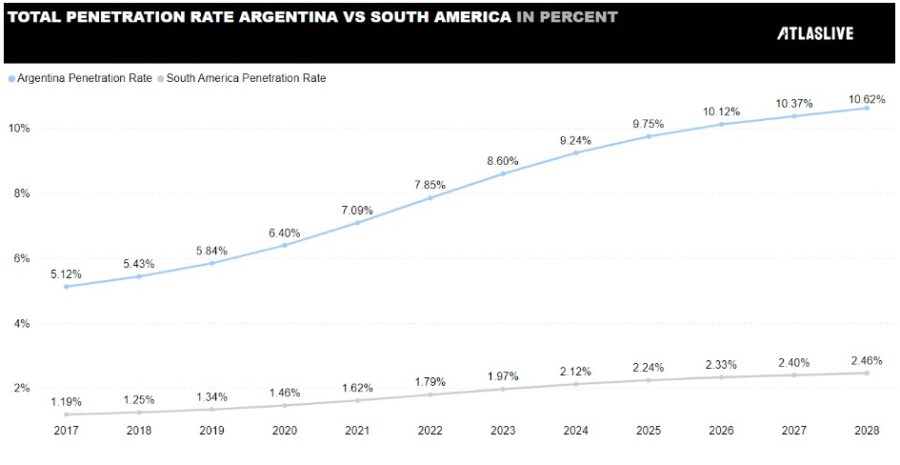

Argentina’s penetration rate has shown consistent growth from 2017 (5.12 per cent) to 2028 (10.62 per cent). The growth trajectory is smooth, with no dips, indicating a steady increase in market penetration over the years. Over the period, Argentina’s penetration rate more than doubled, suggesting a significant expansion of the igaming market within the country.

The penetration rate in South America as a whole has increased at the same pace as Argentina’s but at a lower base. Starting at 1.19 per cent in 2017, it reaches 2.46 per cent by 2028. Thus, a huge gap between Argentina and the broader South American market remains. In 2017, Argentina’s penetration rate was about 4,3 times higher than South America’s ( 5,12 per cent vs 1,19 per cent); by 2028, this difference will stay the same with a difference of over 8 percentage points.

This significant outperformance suggests that Argentina could be seen as a leading market within South America, potentially offering more mature or lucrative opportunities compared to other countries in the region.

Companies operating in the igaming sector might consider focusing more resources on Argentina to capitalize on its high penetration, while also exploring strategies to boost engagement and penetration in the wider South American market, where there appears to be room for growth.

Boosting South America’s iGaming: Atlaslive’s dynamic Platform

The igaming market in Argentina is poised for continued growth, driven by favourable consumer trends and technological advancements. However, to fully capitalize on these opportunities, operators must address the challenges of slower growth relative to the broader South American region.

Atlaslive is aimed at delivering exceptional experiences and tailored solutions that align with the specific demands of the markets in which it operates. The Atlaslive Platform stands out for its speed, scalability, and reliability. Atlaslive allows for swift modifications and customizations to cater to the unique needs of any market.

By integrating gamification elements and expanding the range of casino games and customizable betting options, Atlaslive creates new avenues for partners to attract a wider audience and improve retention rates. A standout feature driving this innovation is the Atlaslive Bet Builder, which enables users to craft personalized bets across multiple markets within a single event, significantly boosting engagement and user satisfaction.

The Platform’s customization capabilities allow partners to design bonuses and betting experiences tailored to individual users, ensuring that they not only meet but exceed user expectations. Atlaslive’s strategy centres on adapting to the needs of its partners and staying ahead in the evolving Argentine market, offering dynamic, real-time technology that adjusts to the demands of both partners and the market.