AGA: Q3 commercial gaming revenue breaks all-time record

The American Gaming Association has reported that revenue from traditional US casino games, sports betting and igaming surpassed $13.89bn in the third quarter of 2021.

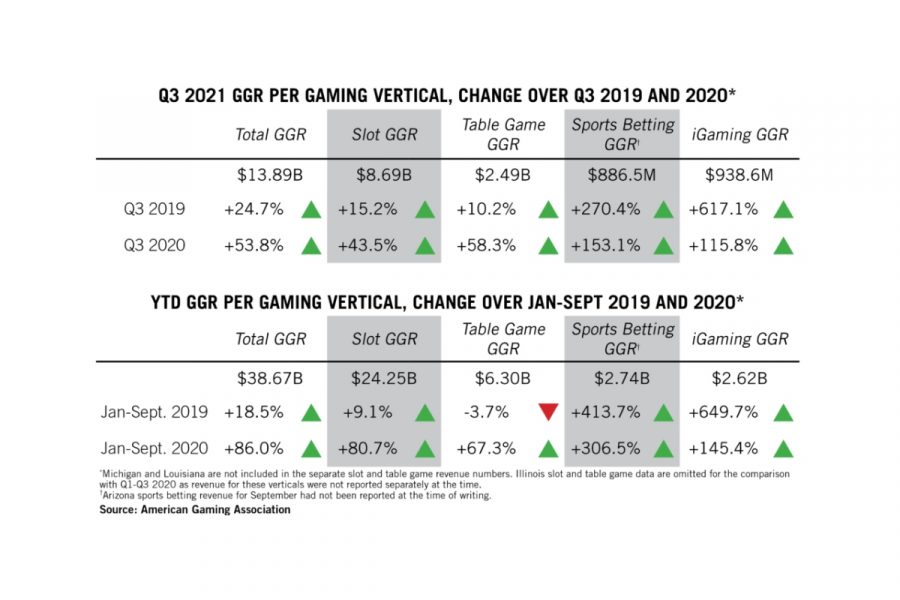

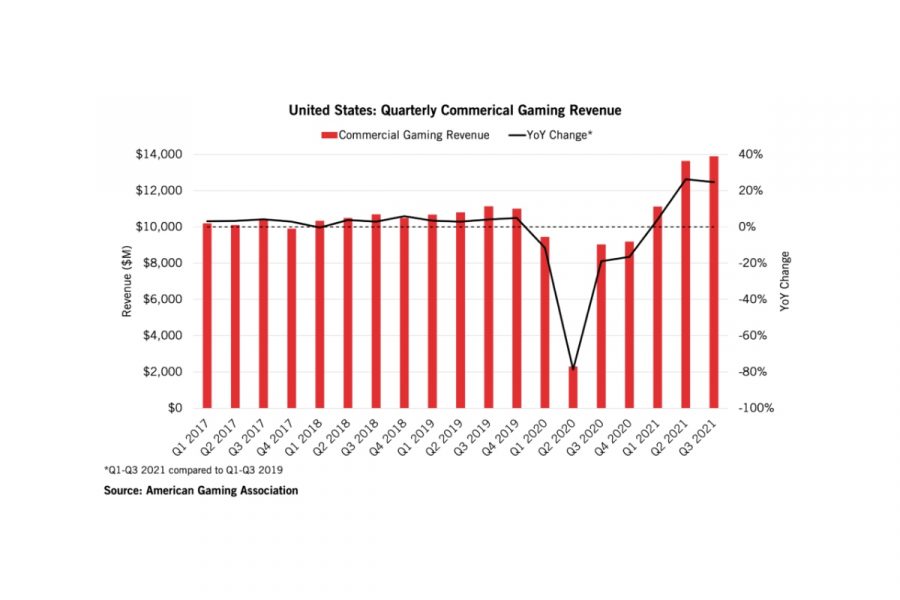

Press Release.- The AGA Commercial Gaming Revenue Tracker shows that nationwide revenue from traditional casino games, sports betting and iGaming surpassed $13.89bn in the third quarter of 2021, marking a new quarterly record. Gaming revenue was up 53.8 per cent over the Covid-19-impacted Q3 2020 and 24.7 per cent higher than Q3 2019.

Gaming’s sustained growth since the end of the first quarter, with monthly gaming revenue not dipping below $4.4bn since February, positions 2021 to become the highest-grossing year in the history of US commercial gaming. In the first nine months of the year, commercial casinos generated $38.67bn, surpassing 2020 total revenue and up 18.5 per cent from the same period in 2019, the current record year.

Despite the recent record-shattering performance, the casino industry has room to grow heading into the final quarter of the year with new commercial gaming markets recently opening in Arizona, Connecticut and Wyoming. Destination markets will benefit from a return of meetings and conventions and the easing of international travel restrictions.

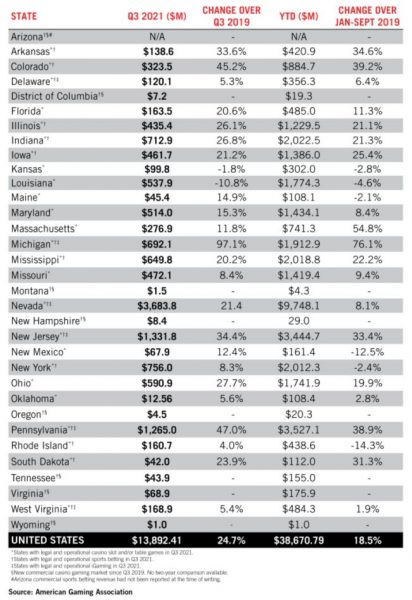

Top gaming states set quarterly revenue records

Consumer demand continued into the third quarter as 10 of 25 commercial casino states reported new quarterly revenue records, including the four highest-grossing states in 2019 – Nevada, New Jersey, New York and Pennsylvania. In Nevada, the quarter also saw the highest ever quarterly gaming win for both Clark Country ($3.16bn) and the Las Vegas Strip ($2.06bn).

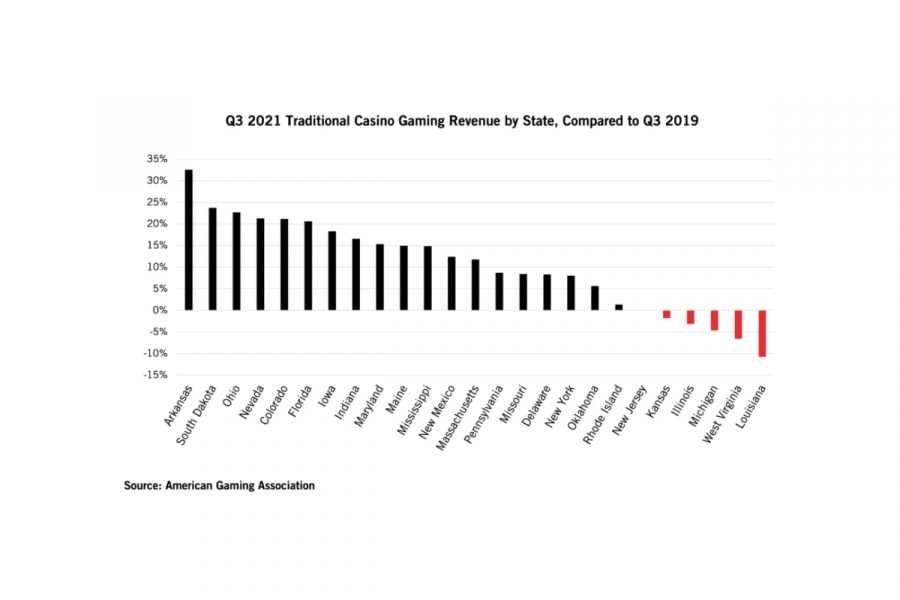

In Louisiana – the nation’s fifth largest gaming state in 2019 – revenue dropped by 10.8 per cent from Q3 2019 as Hurricane Ida forced casinos to shutter for up to two weeks. Kansas was the only other state to see gaming revenue contract from the same period in 2019 (-1.8 per cent).

Traditional gaming revenue reaches all-time high

With commercial casinos able to operate at full capacity, brick-and-mortar gaming generated a record $12.05bn in quarterly revenue: a 1.7 per cent sequential increase and up 11.8 per cent from Q3 2019. In the first nine months of 2021, traditional casino games generated $33.27b – 4.7 per cent ahead of the same period in 2019.

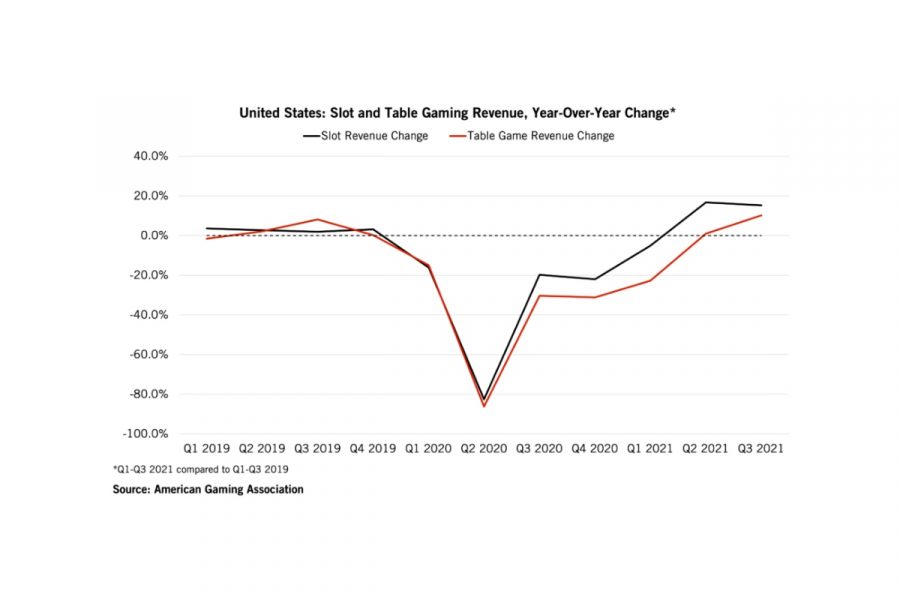

Slot revenue continued to grow at a faster rather than table games in the third quarter, expanding by 15.2 per cent over Q3 2019, compared to 10.2 per cent for table games, though the table game vertical set a new quarterly record with $2.49bn. Casino slot machine revenue was flat (-0.2 per cent) from the previous quarter with $8.69bn generated.

At the state level, 20 of 25 states saw brick-and-mortar casino revenue match or exceed pre-pandemic levels, as only Illinois (-3.2 per cent), Kansas (-1.8 per cent), Louisiana (-10.8 per cent), Michigan (-4.7 per cent) and West Virginia (-6.6 per cent) saw revenue drop compared to Q3 2019.

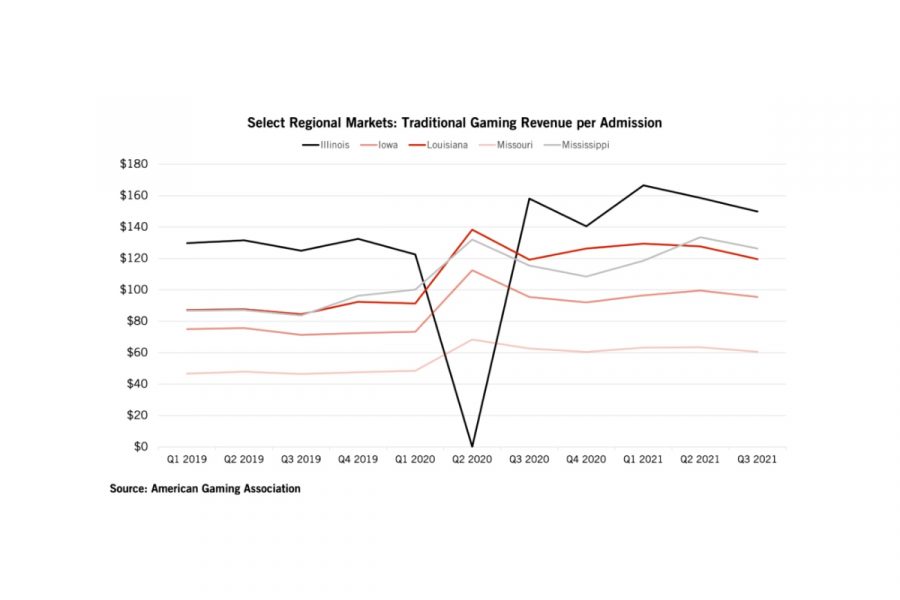

The all-time high revenue generated from traditional casino gaming coincided with a continued high level of spend per casino visit, while the rebound in visitation levels observed in recent quarters showed signs of tapering off in Q3.

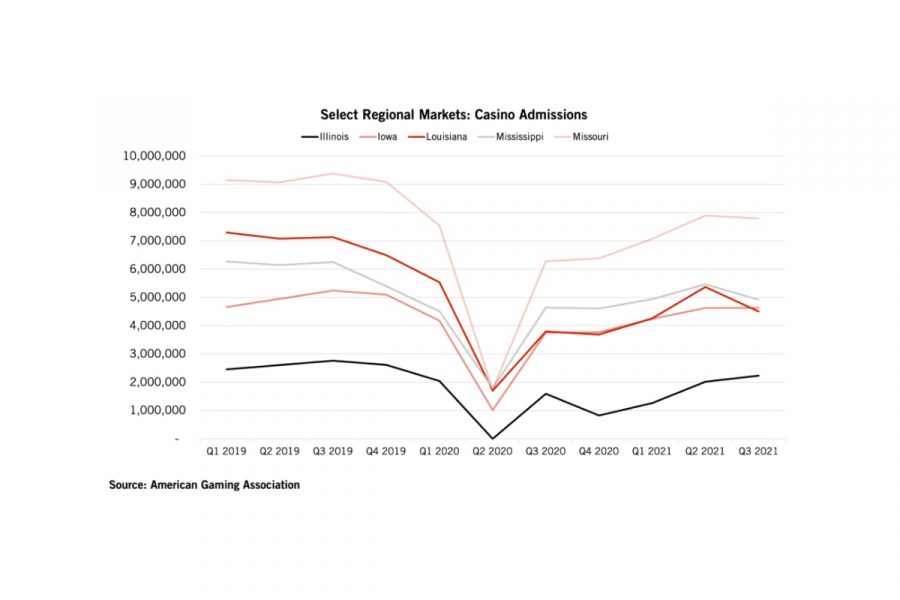

Of the five states that report on casino visitation (Illinois, Iowa, Louisiana, Mississippi and Missouri), only Illinois saw an increase in admissions (10.5 per cent) over the preceding quarter. Compared to Q3 2019, visitation in the five regional casino markets was down between 11.7-36.9 per cent.

But as regional casino visitation stabilized in the third quarter, destination markets continued to gain momentum. Data from the Las Vegas Convention and Visitors Authority shows that 9.2m people visited Las Vegas in the third quarter, a 14.0 per cent decrease from Q3 2019 but a sequential increase of 9.7 per cent over Q2 2021, and the highest quarterly visitation level since the outbreak of COVID-19.

Lower visitation continues to be more than offset by increased spending by those who do visit casinos. As the pandemic continues to limit access to other entertainment forms, consumers are allocating a larger share of recreational spend to gaming, according to analysts. Traditional casino gaming revenue per admission in the five states was up between 20.0 and 50.9 per cent from the same period in 2019.

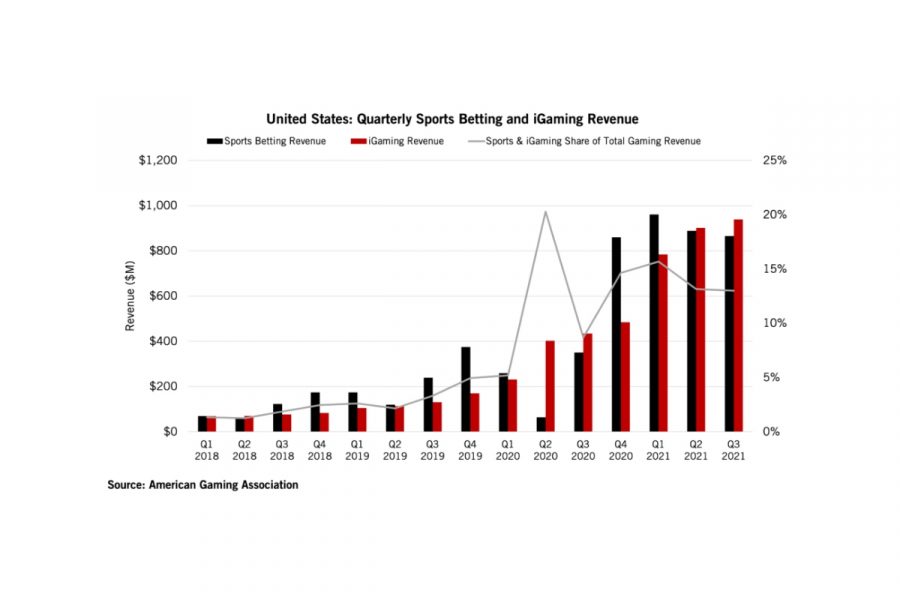

Sports betting and igaming combine for $5.3bn in first three quarters

While the record performance of brick-and-mortar casino games drove overall gaming revenue to an all-time high, igaming also set a quarterly record with the vertical growing 4.1 per cent from the preceding quarter to $938.6m.

Sports betting revenue generated $886.5m in the third quarter, up 153.1 per cent from a year ago. The limited summer sports calendar drove a quarterly low for 2021 in both revenue and handle, $11b compared to $13.02b in Q1 and $11.10bn in Q2.

Combined revenue from sports betting and iGaming accounted for 13.1 per cent of total gaming revenue in Q3 2021, level with the second quarter and down from 15.7 per cent in the first quarter.

In the first nine months of 2021, igaming generated $2.62bn in revenue, growing 145.4 per cent from the same period in 2020, while sports betting revenue reached $2.74bn, up 306.5 per cent.