A $2.7bn market: Atlaslive analyses the surge of igaming in Mexico

Atlaslive brings insights, packed with numbers, metrics, and comparisons to the wider LatAm region, to show off Mexico’s unique position and rapidly growing potential in the igaming industry.

Opinion.- The igaming market in Mexico offers a compelling blend of cultural richness and regulatory evolution. Gambling has been part of Mexican culture for centuries, and the country’s regulatory framework for online gaming has evolved to meet the demands of modern-day players.

It wasn’t until 2004, with the passage of the Federal Games and Raffles Law, that online gambling was officially permitted, giving rise to legal online casinos and sports betting. This regulatory shift paved the way for domestic and international operators to enter the market, although Mexico still maintains some restrictions, which you can learn more about in the article.

Today, Mexico’s igaming market is one of the largest in Latin America, with growing demand for both online casinos and sports betting. Despite the regulatory framework, Mexican players prefer sportsbooks, especially during major football events like the Liga MX big matches and international tournaments.

Atlaslive continues to dive deep into market research, and this time its focus is on the vibrant igaming market in Mexico. The article brings together valuable insights, packed with numbers, metrics, and comparisons to the wider LatAm region, showing off Mexico’s unique position and rapidly growing potential.

Atlaslive sees this as an opportunity to not only cater to these popular trends but also to offer operators customisable igaming solutions that meet both player expectations and regulatory requirements. By balancing innovation with compliance, Atlaslive ensures a secure, engaging experience tailored to the Mexican market.

The rise of Mexico’s igaming industry: revenue, player behaviour, and market reach

To better understand the trajectory of the Mexico market, it is important to focus on data-driven insights and dive into the key metrics shaping the future of igaming in Mexico, including total revenue projections, average revenue per user (ARPU), and market penetration across major categories.

Total revenue growth and expectations by 2028

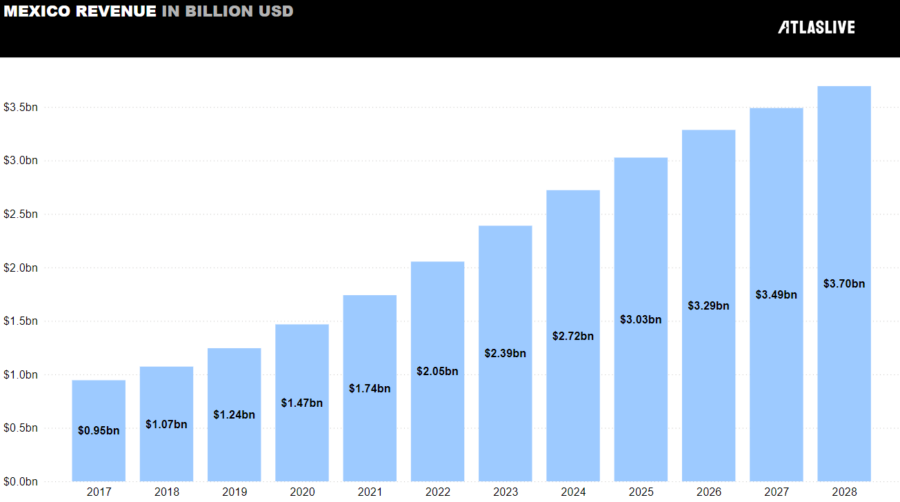

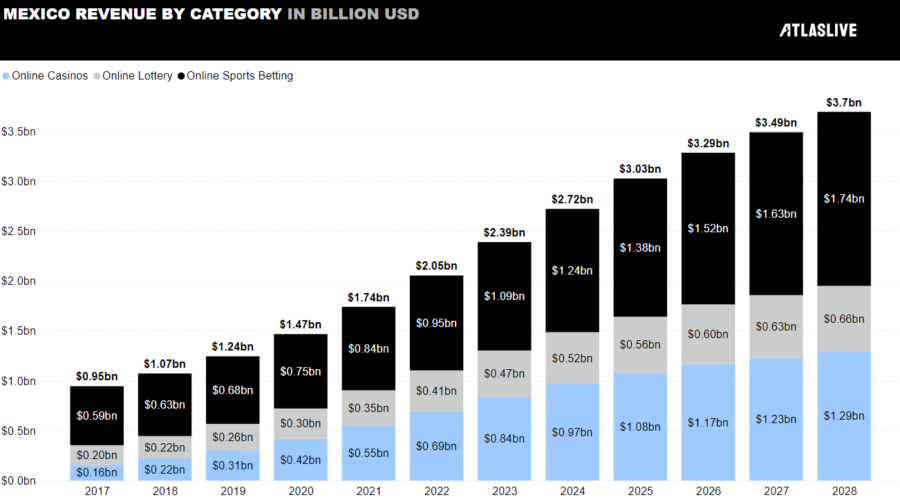

Looking at the total revenue from igaming in Mexico, the market is set to maintain a steady upward trend. As shown in the graph below, the total revenue grew from $2.05 bn in 2022 and is projected to reach $3.7 bn by 2028. This growth is driven primarily by online sports betting and casinos, reflecting Mexican players’ increasing engagement with online platforms.

The continuous rise in revenue points to an expanding player base, as well as increasing spend per user, especially in sports betting. This growth is aligned with global trends as more consumers shift to digital forms of entertainment, supported by the growing accessibility of mobile devices and improved internet infrastructure.

Expected revenue growth decline as a sign of market maturity

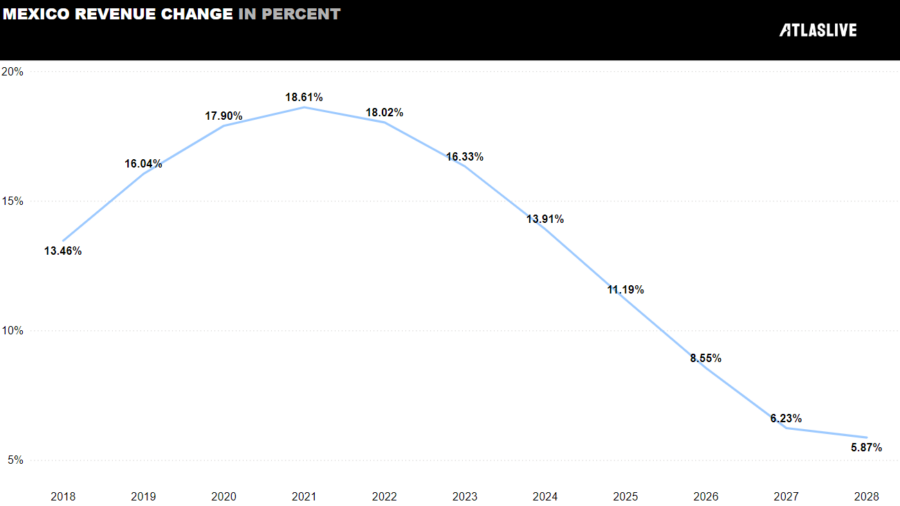

An essential part of the overall story for Mexico’s igaming market is the revenue change percentage, which gives a clear picture of how rapidly or gradually the market is expanding. As shown in the graph, the market experienced its most significant growth between 2018 and 2021, peaking at 18.61 per cent in 2021. This spike was driven by the global shift to online platforms during the pandemic when players increasingly turned to digital entertainment options.

However, as the market matures, growth rates are naturally expected to decline. By 2028, the growth rate is projected to stabilise at 5.87 per cent, indicating that the initial boom in user adoption and spending has levelled off. While this suggests a maturing market, it also highlights the need for operators to focus on retention and enhanced player engagement strategies to sustain growth.

This shift from rapid expansion to consistent growth is an opportunity to capitalise on player loyalty programs, gamification, and innovative product offerings to maintain a strong foothold in the market. Atlaslive igaming Platform is technically flexible which can help to adapt to these changes and respond to the emerging needs of both players and operators.

With Mexico’s total igaming revenue on a steady rise and the market’s growth rate normalising, the country remains a lucrative and dynamic space for operators who are ready to adapt and innovate only with customisable technological capabilities. Atlaslive continues to provide cutting-edge, flexible solutions designed to meet these changing dynamics head-on.

Contribution to the market: ARPU analysis

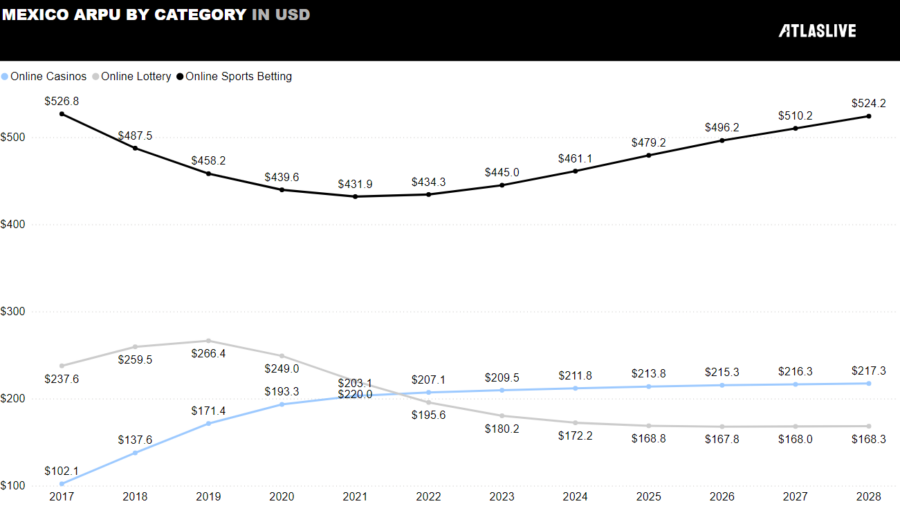

The ARPU (Average Revenue Per User) tells another compelling story about how much individual players contribute to the market. For online sports betting, despite a dip from $526.8 in 2017 to $434.3 in 2023, the ARPU is projected to climb again, reaching $524.2 by 2028. This recovery highlights the resiliency of the sports betting segment and reflects a broader trend of users becoming more engaged and placing higher-value bets.

In contrast, online casino ARPU has seen consistent growth, increasing from $102.1 in 2017 to $216.3 by 2028. This steady rise suggests that online casinos are attracting more serious, higher-spending players, likely drawn by a broader range of gaming options and enhanced user experiences. The online lottery ARPU, while more stable, maintains lower numbers compared to other categories, which could be attributed to its more casual player base.

Market penetration: exploring the future of three key igaming segments in Mexico

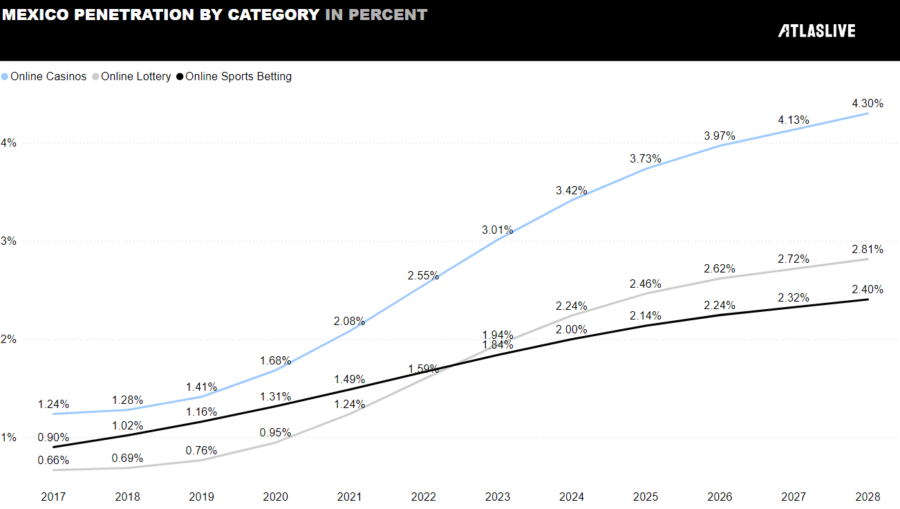

Perhaps the most telling metric is the penetration rate, which reflects how widespread each category is among the Mexican population. Online casino penetration is expected to continue its impressive upward climb, from 1.24 per cent in 2017 to 4.30 per cent by 2028, outpacing the growth of other categories. This signals an increasing appetite for casino-style gaming, likely fueled by its growing popularity across a wider demographic.

Meanwhile, online sports betting is on a steady rise as well, expected to reach 2.40 per cent by 2028, reflecting its strong ties to the local sports culture, especially during major events and international football tournaments. Online lottery, while the smallest in terms of penetration, remains steady with incremental growth projected to hit 2.81 per cent by 2028, underscoring its niche but consistent market presence.

In Mexico’s rapidly growing igaming market, the rising ARPU and expanding penetration rates show clear signs of player engagement and a growing audience. Atlaslive, the dynamic igaming Platform, knows how to help operators tap into this growth with flexible solutions that match market trends and local regulations.

A closer look at player and top three igaming categories

Mexico, with a population of around 130 million and a high urbanisation rate of 81.6 per cent, is a youthful and fast-growing market for digital entertainment, including igaming. The country has one of the youngest demographic profiles globally, with a median age of 30.8 years. These factors contribute to Mexico being a top contender in the global igaming market and one of the top countries in terms of monthly visits to casino websites. This combination of youth, urbanisation, and a tech-savvy population makes Mexico an incredibly fertile ground for online gaming growth.

Why 6 million Mexicans will be playing online casinos by 2028

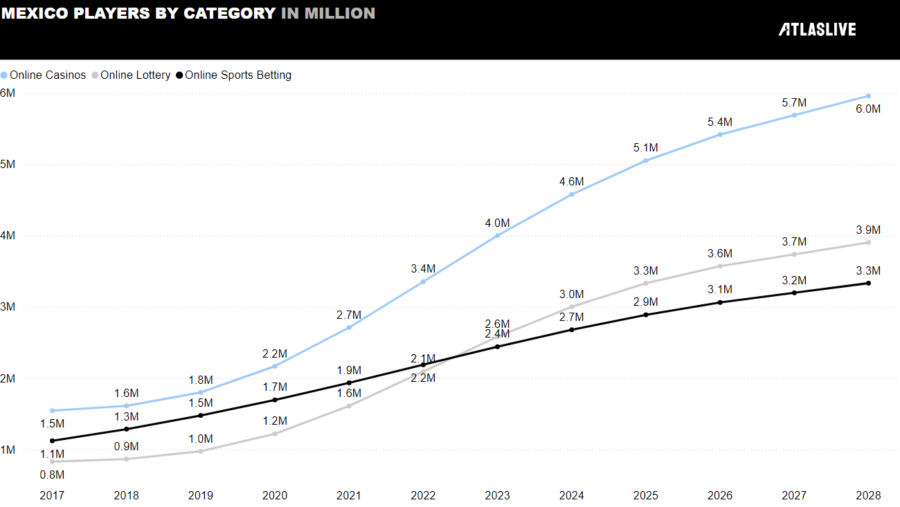

When evaluating Mexico’s igaming players by category, it becomes clear that online casinos are poised for significant growth. In 2017, there were 1.5 million online casino players, and this number is expected to quadruple by 2028, reaching 6 million. This reflects a growing interest in interactive, immersive gaming experiences that casinos offer, likely driven by advancements in technology such as mobile gaming and virtual reality, which continue to make casino games more accessible and appealing to a broader audience.

Revenue from online casinos is projected to surge alongside this growth, increasing from $0.16bn in 2017 to $1.29bn by 2028, showcasing the rising spending power of Mexican players. Historically, the allure of casino-style gaming in Mexico can be traced back to its rich cultural traditions of games and competitions. Today’s players are combining this historical love for chance-based games with modern conveniences and accessibility to different gaming platforms.

The driving force behind sports betting in Mexico

Online sports betting, another category with deep cultural roots in Mexico, particularly in football, shows consistent growth. In 2017, there were 1.5 million sports bettors, which is anticipated to more than double by 2028, reaching 3.3 million. Sports, especially football, play a central role in Mexican life, and betting on these events only enhances fan engagement.

The revenue generated from online sports betting is expected to grow exponentially, rising from $0.59 billion in 2017 to a forecasted $1.74bn by 2028, making it the largest segment in the Mexican igaming market.

Online lotteries: A steady and growing segment of Mexican igaming

While online lotteries attract a smaller but steady player base, growing from 1.1 million players in 2017 to 3.9 million by 2028, it’s important to note that lotteries are a deeply entrenched tradition in Mexico, offering a more casual and accessible form of gaming. The enduring popularity of lotteries is supported by players who seek low-stakes, high-reward opportunities, providing operators with a consistent revenue stream.

Lottery revenues, although smaller compared to casinos and sports betting, are set to grow steadily to $0.66bn by 2028, maintaining its place as a reliable source of income for operators.

Atlaslive offers a comprehensive igaming solution that covers all major gaming categories, including online casinos, lotteries, virtual games, and sports betting. The platform is continuously evolving, adding new features and tools to deliver the best user experience on the market. Through partnerships with established gaming providers, payment systems, and operators across various regions, Atlaslive stays adaptable and up-to-date with market trends.

A comparative look at Mexico within LatAm

Latin America is quickly becoming a key area for igaming operators looking to enter new markets. The region is diverse and actively developing, with regulations and growth taking shape over the past few years. Mexico, being one of the important markets in this region, offers an interesting comparison when you look at it alongside the broader LatAm trends.

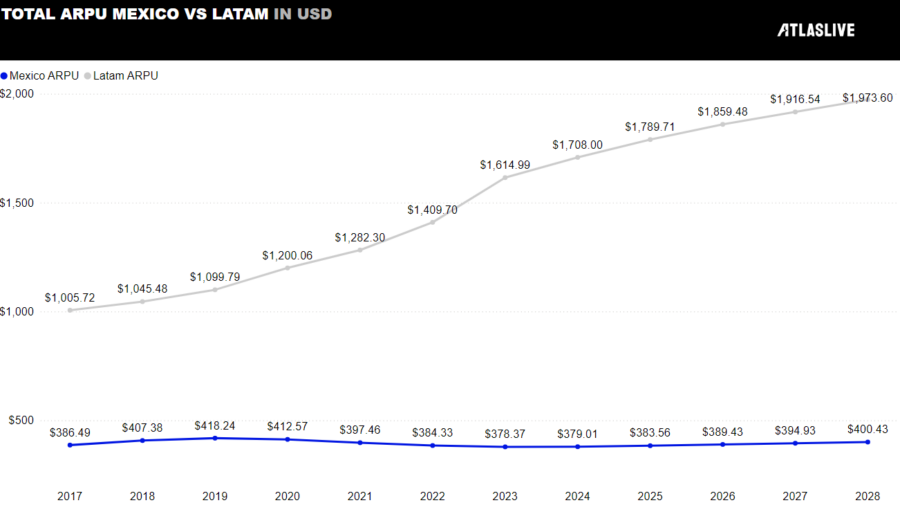

Mexico vs LatAm: ARPU comparison

Looking at ARPU from 2017 to 2028, LatAm shows a steady climb, starting at $1,005.72 in 2017 and reaching $1,973.60 by 2028. Mexico, on the other hand, stays much lower, starting at $386.49 in 2017 and gradually growing to $400.43 by 2028. This clear difference suggests that LatAm’s higher ARPU could be due to more diverse betting options and bigger spending by players. Mexico’s slower ARPU growth might point to different player habits or a slower uptake of betting activities. The more gradual increase in Mexico may also be influenced by specific rules or economic factors that impact how much players spend compared to the rest of LatAm.

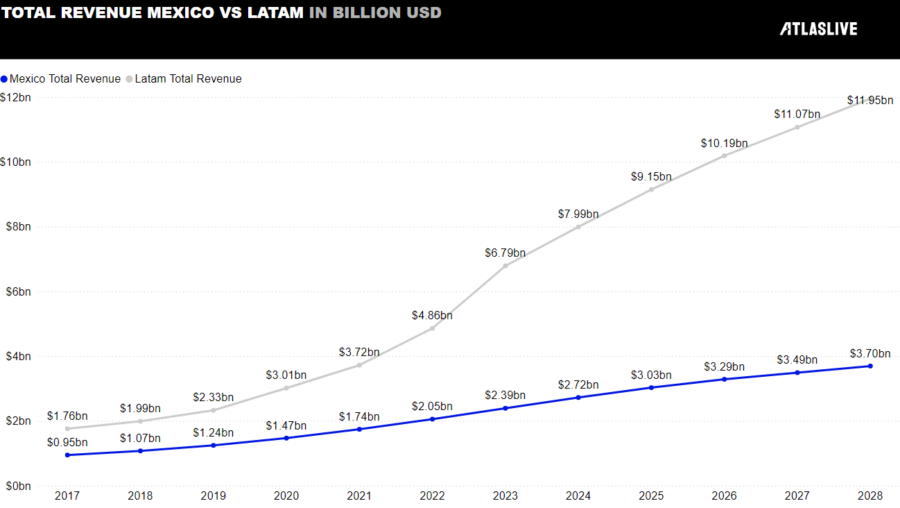

Mexico vs LatAm: Total revenue comparison

Total revenue tells a similar story on a larger scale. LatAm’s revenue sees strong growth, jumping from $1.76bn in 2017 to $11.95bn in 2028. Mexico grows at a slower rate, moving from $0.95bn in 2017 to $3.70bn by 2028. While Mexico is growing, it doesn’t keep pace with the rest of LatAm. The major contributors to LatAm’s growth likely come from markets like Brazil and Argentina, where igaming is expanding faster. Mexico’s slower growth may be due to factors like regulatory challenges or market fragmentation holding back its full potential.

Atlaslive’s deep understanding of these market differences enables the creation of customisable solutions tailored to the unique needs of operators in the LatAm region. The innovative Sportsbook Platform assists operators in benefiting from the growth potential of these diverse markets.

Licensing and regulation in Mexico’s igaming market

Mexico is one of the largest and most promising markets for online gaming, but its regulatory framework still faces some challenges. While Mexico was a pioneer in gaming regulation over 15 years ago, many operators in 2024 still lack the necessary SEGOB license from the federal authority.

The Federal Law of Games and Draws, dating back to 1947, remains the main legal structure for the industry. Despite its age, it has been updated to address modern issues like money laundering, integrity, and online gaming. Unlike countries like Spain and Argentina, where gaming is regulated at the provincial level, Mexico’s federal government is responsible for all gaming activities.

Tech advancements and growing participation from both local and international operators have driven the market’s development, especially as Mexico prepares to co-host the FIFA World Cup in 2026. With this momentum, efforts to modernise gaming regulations are accelerating, and clearer rules for online gaming are expected soon.

Despite progress, challenges remain, particularly with unlicensed operators who continue to operate without legal oversight, highlighting the need for stronger enforcement to ensure compliance across the board.

Key takeaways for success in Mexico’s igaming sector with Atlaslive

The Mexican igaming market is transforming, making online platforms more accessible than ever. This market growth brings both opportunities and challenges for operators entering local business opportunities in igaming.

Key strengths:

- Practically unlimited license availability.

- A diverse range of real-money gaming products.

- Freedom to advertise gambling services.

Challenges:

- Laws that focus mainly on physical gambling operations.

- A relatively high tax burden for operators.

- Insufficient measures for maintaining market integrity.

Despite some challenges, the Mexican gaming sector has seen impressive growth, supported by consumer demand and a rising penetration rate. Many international operators are partnering with licensed companies in Mexico, further expanding the market. Sports betting, especially football and baseball, is a big draw, with football commanding most of the attention.

However, competition from established global operators remains tough. Local operators must strive to match the quality of sportsbooks and casinos seen in more developed markets. The dynamic igaming Platform, like Atlaslive, offers complete, ready-to-go solutions, helping businesses enter the market without the burden of building their own infrastructure. With a comprehensive Payment Hub, Risk Management Tool, Business Analytics, Bonus Engine, and more, the Platform provides a powerful foundation for any developing partner in Mexico.

As technology adoption surges and the demand for high-quality gaming experiences grows, Atlaslive’s dynamic Platform stands ready to support operators. The customisable and flexible nature of Atlaslive’s offerings ensures that businesses can provide the tailored user experiences Mexican players seek, including intuitive UX, personalisation, and gamification.

Moreover, Atlaslive’s modular architecture and compliance tools ensure the platform adapts quickly to regional laws, maintaining full functionality and regulatory compliance. The B2B igaming provider is well-positioned to support the expansion of igaming in Mexico and beyond, offering a secure, adaptable Platform that meets the needs of today’s operators.