Sportradar reports strong growth and increased profitability and cash flow

Sportradar announced financial results for its third quarter 2022.

Press release.- Sportradar, the leading global technology company enabling next-generation engagement in sports and provider of business-to-business solutions to the global sports betting industry, today announced financial results for its third quarter ended September 30, 2022.

Third quarter 2022 highlights

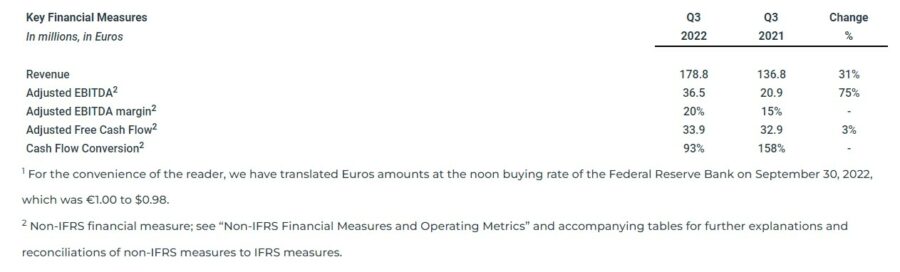

- Revenue in the third quarter of 2022 increased 31 per cent to €178.8m ($175.2m) compared with the third quarter of 2021. 2022 year-to-date revenue grew 28 per cent compared to the same nine months in 2021.

- The RoW Betting segment, accounting for 56 per cent of total revenue, grew 28 per cent to €100.9m ($98.9m), driven by a strong performance from our Managed Betting Services (MBS).

- U.S. segment revenue grew 61 per cent to €31.6m ($31.0m) compared to the third quarter of 2021, driven by strong market growth and positive adoption of in-play betting. The U.S. segment turned profitable for the first time since the Company’s initial public offering and generated a positive Adjusted EBITDA margin of 11 per cent.

- The Company’s Adjusted EBITDA in the third quarter of 2022 increased 75 per cent to €36.5m ($35.8m) compared with the third quarter of 2021 as a result of strong revenue growth even with continuous investments in the Company’s growing business.

- Adjusted EBITDA margin was 20 per cent in the third quarter of 2022, an increase of 500 bps compared to the quarter for the prior year period and 400 bps higher compared to the second quarter of 2022.

- Adjusted Free Cash Flow in the third quarter of 2022 increased to €33.9m, compared to €32.9m for the prior year period. The resulting Cash Flow Conversion was 93 per cent in the quarter.

- During the quarter, the Company prepaid €200.0m of its outstanding debt. As of September 30, 2022, total debt was €236.9m, and cash and cash equivalents totalled €512.5m.

- The Company has raised its guidance for revenue and the lower end of its Adjusted EBITDA range for the full year 2022.

Carsten Koerl, chief executive officer of Sportradar said: “Our strong performance in the third quarter exceeded our expectations across all key financial metrics. We consistently managed to grow revenue, profitability and cash flows despite adverse market conditions during the first three quarters of 2022. The Company exceeds expectations quarter-in and quarter-out, and as a result of our operational performance – in particular the U.S. and the betting rest-of-world business – as well as our organizational streamlining, we are able to raise our full-year guidance for revenue and increase the lower end of our Adjusted EBITDA range.”

“We are proud of the continuous success of our U.S. operations. We managed to generate a U.S. profit for the first time in the third quarter, displaying solid operational leverage in the business model. Underpinning this success is the extension of our long-term partnership with FanDuel. This partnership is a testimony to our strategy, to expand our relationships and become an embedded technology provider for our customers, based on strategic long-term deals with our league partners.”

Ulrich Harmuth, interim chief financial officer added: “The financial results in the third quarter demonstrated that Sportradar consistently has managed to grow almost three times faster than the underlying betting market and our growing scale has led to margin expansion – as indicated by the U.S. segment turning profitable in the third quarter. As a result of this strong momentum and based on what we can see today, our 2023 preliminary expectations are for revenue to grow in the mid-20s per cent while expanding the Adjusted EBITDA margin above 2022 levels.

Segment information

RoW Betting

Segment revenue in the third quarter of 2022 increased by 28 per cent to €100.9m compared with the third quarter of 2021. This growth was driven primarily by increased sales of our higher value-add offerings including Managed Betting Services (MBS), which increased 84 per cent to €38.2m, and Live Odds Services, which increased 12 per cent to €27.1m. MBS growth was attributable to a record annualized turnover of €19.0bn and the success of our strategy to move existing customers to higher-value add products.

Segment Adjusted EBITDA in the third quarter of 2022 increased 8 per cent to €48.2m compared with the third quarter of 2021. Segment Adjusted EBITDA margin decreased to 48 per cent from 57 per cent in the third quarter of 2021 driven by inorganic investments into AI capabilities for our MBS business, expanding the company’s sports rights portfolio, as well as temporary cost savings in sports rights and scouting from the prior year due to the Covid-19 pandemic.

RoW Audiovisual (AV)

Segment revenue in the third quarter of 2022 increased by 14 per cent to €33.1m compared with the third quarter of 2021. Growth was driven by cross-selling audiovisual content to existing data customers and expanding AV portfolio sales with existing AV customers.

Segment Adjusted EBITDA in the third quarter of 2022 increased 32 per cent to €12.6m compared with the third quarter of 2021. Segment Adjusted EBITDA margin increased to 38 per cent from 33 per cent compared with the third quarter of 2021 as a result of AV revenue growth.

United States

Segment revenue in the third quarter of 2022 increased by 61 per cent to €31.6m compared with the third quarter of 2021. This growth was driven by a strong increase in U.S. betting services, driven by cross-selling non-data products to betting operators as well as benefiting from our customers’ growth as a result of a development in the underlying market and new states legalizing betting.

Segment Adjusted EBITDA in the third quarter of 2022 was €3.4m compared with a loss of €6.6m in the third quarter of 2021, primarily driven by enhanced operating leverage as a result of the growing scale of our business despite continuous investments in the U.S. segment’s products and content portfolio. Segment Adjusted EBITDA margin improved to 11 per cent from (34 per cent) compared to the third quarter of 2021.

Non-IFRS financial measure; see “Non-IFRS Financial Measures and Operating Metrics” and accompanying tables for further explanations and reconciliations of non-IFRS measures to IFRS measures.

Turnover is the total amount of stakes placed and accepted in betting.

Costs and Expenses

Purchased services and licenses in the third quarter of 2022 increased by €18.1m to €47.5m compared with the third quarter of 2021, reflecting continuous investments in content creation and processing, higher event coverage and higher scouting costs. Of the total, approximately €13.7m was expensed sports rights.

Personnel expenses in the third quarter of 2022 increased by €16.9m to €68.3m, an increase of 33 per cent compared with the third quarter of 2021. Adjusted for inorganic hires, personnel costs grew 27 per cent compared to the third quarter of 2021.

Other Operating expenses in the third quarter of 2022 decreased by €4.9m to €20.3m, as a result of our efforts to increase the effectiveness of our central services and due to one-time costs resulting from our initial public offering in September 2021.

Total sports rights costs in the third quarter of 2022 increased by €5.9m to €34.6m compared with the third quarter of 2021, primarily a result of costs associated with newly acquired rights in 2022 for the ITF, UEFA and ATP.

Recent Business/Company Highlights

Sportradar and FanDuel sign a long-term agreement for Official NBA data through the 2030-31 season. Providing FanDuel with a comprehensive portfolio of betting products and entertainment tools, Sportradar remains the preferred data and odds supplier to FanDuel through 2031. Using official NBA data, Sportradar and FanDuel will collaborate to enhance the sports betting experience with new offerings such as certain player tracking data to create props and same game parlays. Additionally, FanDuel will use Sportradar’s proprietary Live Channel Trading (LCT) product.

Sportradar reaffirms its leadership position in the cricket market with partnerships with Australian Premier Cricket competitions. Sportradar announced the renewal of partnership agreements with the top-tier club cricket competitions in Tasmania, Queensland, and Western Australia. Currently, Sportradar partners with every single state and territory cricket governing body in Australia. Extensions with these clubs enable Sportradar to remain the official streaming partner until mid-2025

Sportradar and International Golf Federation enter integrity partnership. Sportradar’s Integrity Services (SIS) unit signed a multi-year integrity partnership with the International Golf Federation (IGF). Under the terms of the initial two-year agreement, SIS will provide bet monitoring through its Universal Fraud Detection System (UFDS) for several IGF competitions. Sportradar Integrity Services have detected more than 7,300 suspicious matches during the past 17 years, with over 600 taking place in 2022 alone.

Tennis Data Innovations and Sportradar team up to expand official tennis data distribution. The partnership sees the launch of a “new secondary feed,” to enable the provision of betting-related services based on official ATP Tour and ATP Challenger Tour scores to a suite of global bookmakers. Of significance, the partnership sees the ATP change its data framework, allowing bookmakers to have uninterrupted access to official data, as scores to date have been delivered directly from the umpire’s chair.

Sportradar continues to evolve its organizational structure to set it up for continued success in achieving its strategic goals around growth, organizational effectiveness and efficiency. The Company is optimizing its organization by appointing global leaders for content creation, product development and commercial excellence – with the U.S. retaining a dedicated go-to-market approach. With this new structure, the Company will become faster in decision-making and execution, and will be more effective and efficient in serving global customers with a growing global product portfolio. The net effect will also be to significantly reduce the number of direct reports to the CEO.

Annual financial outlook

Sportradar has updated its outlook for revenue and Adjusted EBITDA for fiscal 2022 as follows:

- Sportradar has raised its revenue outlook for fiscal 2022 to a range of €718.0m to €723.0m ($703.6m to $708.5m), from its previous range of €695.0m to €715.0m representing prospective growth of 28 per cent to 29 per cent over fiscal 2021.

- Outlook for Adjusted EBITDA is narrowed to a range of €124.0m to €127.0m ($121.5m to $124.5m) from the previous range of €123.0m to €133.0m, representing 22 per cent to 24 per cent growth versus last year.

- Adjusted EBITDA margin is expected to be in the range of 17 per cent to 18 per cent.

See also: Carsten Koerl, CEO & founder of Sportradar, named EY Entrepreneur of the year