Nuvei analyses how payments technology is reshaping revenue optimization in the esports industry

Nuvei reviewed the outlook for esports industry, including the role sports betting will have in industry growth.

Press release.- Nuvei Corporation, tomorrow’s payment platform, in connection with PayPal and Esports Insider conducted a survey of over 100 esports teams, event organizers, talent management and betting companies to better understand how their operations are growing, their outlook on the future of the industry and the role payments play in fueling this expansion.

According to the company, over the last two decades, esports has grown into a $1+ billion industry (Newzoo Global esports & Live Streaming Market Report 2022), in turn evolving into something far more expansive than gamers simply competing for glory.

Players became professionals. Event organizers became media conglomerates. Teams became recognisable brands and recognisable brands founded teams.

With this growth, the complexity of esports companies’ operations increased significantly. Esports is diversifying and expanding while facing unprecedented challenges.

With Covid-19 (and the viewership growth it brought) fading and the global economy on an unstable footing, the readily available investments that previously fueled esports will not be as accessible going forward.

Instead of relying on investments, esports companies must find ways to monetize the audience directly. They will need effective tools to process these transactions. Payment processing will play a major role in the growth of esports.

The survey revealed there is growing acceptance among esports companies of the importance of betting, but they are reluctant to engage with betting directly.

77 per cent of surveyed esports companies indicated that betting is important to the future of the industry, but only 35 per cent said it was important to their business.

In fact, 58 per cent of esports companies are concerned about the impact gambling will have on the industry, despite recognizing how important betting is.

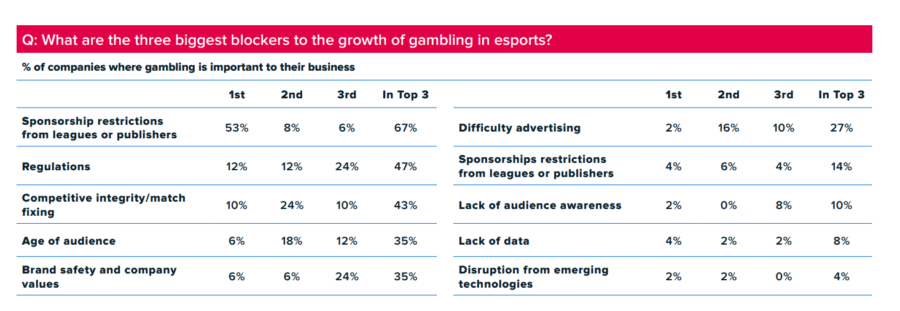

Due to these concerns, betting is the most restricted sponsorship category by leagues and publishers. 67 per cent of esports companies involved in betting say these restrictions are the biggest barrier to the growth of betting in the industry – even more important than government regulations (47 per cent) or competitive integrity concerns (43 per cent).

These restrictions have incentivised betting companies to find other ways to reach the esports audience.

The report concluded:

- Esports companies are diversifying their revenue streams to better monetize their audience. This is leading to increasingly complex operations.

- Despite touching all aspects of the business, improving the payment process is an overlooked opportunity to grow revenue.

- Teams and event organizers want help maximizing the value of their transactions in a way that will not require more thought or effort.

- Due to its international audience and increasing complexity, the esports industry needs flexible payment providers that will help address its concerns.

See also: Kindred selects Nuvei to enhance their payment offering