GBGC: Asia’s casinos and VIPs

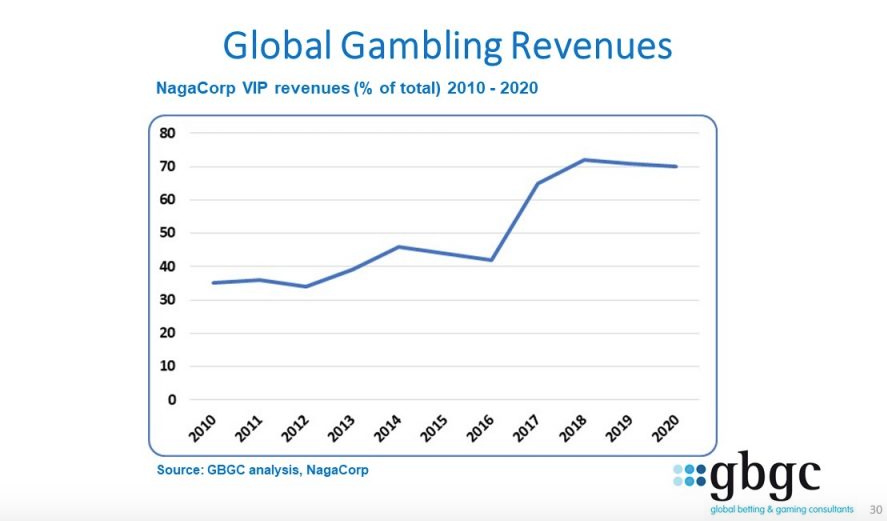

Over the last decade, NagaCorp’s profile became more weighted in favour of the VIP sector.

Press release.- The consequences of the crackdown on junket operators are being felt well beyond Macau. Suncity, for example, was active in jurisdictions such as Cambodia, the Philippines and South Korea.

Several of the VIP rooms have already been closed for long periods of the last two years because of the Covid-19 pandemic, so the impact on revenues might not be so obviously dramatic. But, in the medium-term, the restriction on the Chinese VIP sector will alter the business model for many casinos in the region.

In Cambodia, for many years NagaCorp was not overly reliant on VIPs. In 2010 VIP revenues accounted for 35% of revenues and its mix of revenues was balanced.

Over the course of the last decade, NagaCorp’s profile became more weighted in favour of the VIP sector. This was especially the case after it started working with SunCity, Tak Chun and Guangdong Group. Between 2018 and 2020 VIPs accounted for 70%+ of revenues each year.

See also: Warwick Bartlett: “Casinos will have to shrink until we have a clear path”