AGA reports new quarterly record for gaming revenue

US commercial gaming revenue reached $15.17bn in Q3 2022.

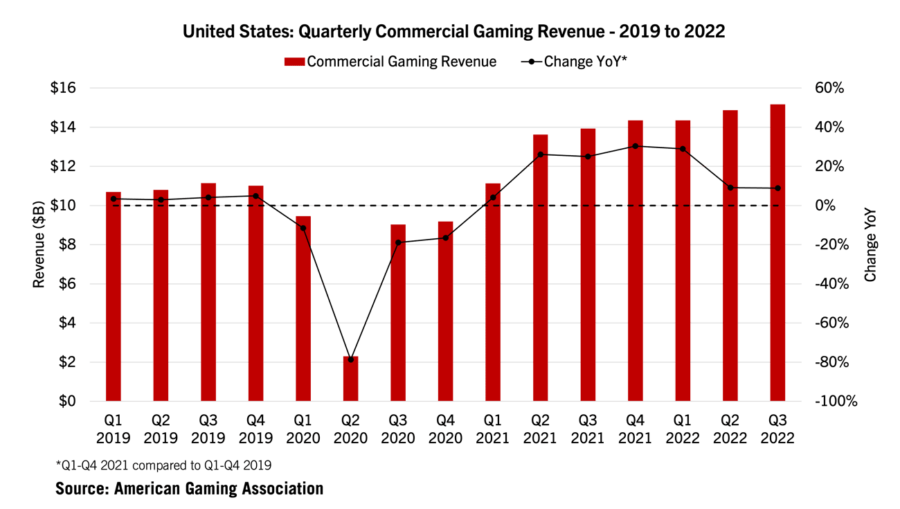

US.- The American Gaming Association (AGA) has reported that US commercial gaming revenue reached a quarterly record of $15.17bn in Q3 2022. The all-time high beats the previous record of $14.81bn in Q2 2022 by 2 per cent.

The year-on-year growth rate was 8.8 per cent, outperforming the broader US economy’s 2.6 per cent. Land-based slots and table games generated a record $12.27bn, up 1.8 per cent from Q3 2021. Sports betting also set a new quarterly revenue record of $1.68bn, up 80.6 per cent year-over-year. Igaming revenue was steady at $1.21bn.

Together, sports betting and iGaming combined for $2.89bn in quarterly revenue, comprising 19.1 per cent of total gaming revenue, up from an 18.1 per cent share in Q2 but lower than the 19.7 per cent captured in Q1.

The AGA’s Commercial Gaming Revenue Tracker shows that 2022 is on pace to surpass 2021 revenue, tracking 14.7 per cent ahead of 20211 for the first nine months and already surpassing full-year revenue for 2019.

Meanwhile, trailing 12-month (TTM) revenue, covering the past twelve consecutive months from Oct 2021 through Sep 2022, was $58.73bn. TTM is a measurement that is both current and seasonally adjusted. Gaming revenue over the last 12 consecutive months was up one per cent from the preceding TTM period (Sept 2021-Aug 2022).

Sixteen states set quarterly record, 24 On Pace for Record Year

At the state level, 29 of 33 commercial gaming jurisdictions that were operational one year ago increased Q3 revenue from 2021. Sixteen states (in green below) marked all-time records for a single quarter, including five of the country’s six largest commercial gaming markets: Indiana ($728.0m), Michigan ($796.5m), Nevada ($3.77bn), New York ($1.06bn) and Pennsylvania ($1.33bn).

Quarterly revenue contracted in four jurisdictions compared to Q3 2021 as Delaware, Maine and Mississippi reported minor drops of between 0.6 and 3.5 per cent, while the small sports betting-only market in Washington, D.C. continued to lose ground to neighbouring Maryland and Virginia.

Through September, nearly all states remain on track to exceed 2021 revenue totals, with only three jurisdictions trailing last-years performance through Q3: Washington, D.C. (-20.1 per cent), Mississippi (-3.4 per cent) and South Dakota (-1.0 per cent). Twenty-four of 30 jurisdictions that were operational throughout 2021 are so far outpacing their respective revenue record for a full calendar year.

AGA president and CEO Bill Miller said: “While business challenges remain, high consumer demand continues to fuel our industry’s record success. Our sustained momentum in the face of broader economic volatility points to gaming’s overall health today and provides confidence as we look to the future.”

See also: Record 46.6 Million Americans Plan to Wager on 2022 NFL Season