Sportradar shares its financial results for the third quarter of the year

Sportradar today announced financial results for its third quarter ended September 30, 2021.

Press release.- Sportradar released its financial results for the third quarter. This is Sportradar’s first results following its successful IPO in September.

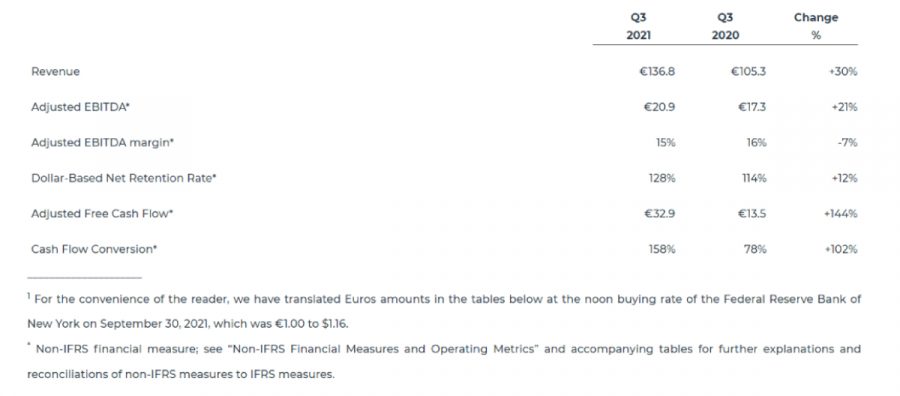

Third Quarter 2021 Highlights

- Revenue in the third quarter of 2021 increased 30 per cent compared to the third quarter of 2020 to €136.8m ($158.7m)1, driven by robust growth across all geographies and business segments

- Continued strong performance in the U.S. market with U.S. revenue in the third quarter of 2021 increasing by 119 per cent compared to the third quarter of 2020. For the nine months ended September 30, 2021 the U.S. revenue reached €48.5m ($56.3m)1

- Adjusted EBITDA* in the third quarter of 2021 was up 21 per cent compared to the third quarter of 2020 to €20.9 million ($24.2m)1

- Strong Dollar-Based Net Retention Rate* of 128 per cent at the end of third quarter of 2021, underscoring the continued success of our cross-sell and upsell strategy

- Successfully extended our partnership through 2028 with FanDuel Group, a leader in the U.S. sports betting market, covering pre-match betting services, live betting services, and betting entertainment tools

- Completed successful listing on Nasdaq, raising €546m of primary net proceeds to fund continued growth in the business, providing the Company with €878m to continue to invest in global growth

- For the full-year 2021, we expect revenue to be in the range of €553 to €555 ($641 to $644)1 million and Adjusted EBITDA* in the range of €99.5 to 101.5 ($115.4 to $117.7)1

Carsten Koerl, Chief Executive Officer of Sportradar said: “Our strong results demonstrate the value we provide to our partners and customers around the world. We are the largest provider of sports intelligence in the world and the only profitable global sports technology platform of scale.

“Critically, we believe we are also the most innovative in developing technology solutions that enable our league customers, media and betting partners to use our ever-increasing data to attract and engage sports fans.”

Koerl continued, “We plan to continue to make significant investments, particularly in the U.S. The U.S. represents the primary area of focus to execute on our strategic growth plans, as the U.S. region is currently only 7 per cent of our group revenues, representing a significant potential business opportunity as more states legalize betting and the market expands from $1bn in 2019 to an estimated $23bn in the next 10 years.

“Our recent Nasdaq listing in the U.S. was a tremendous milestone for our team, and we look forward to building on our success in a multitude of areas in the years ahead.”

Segment Information

RoW Betting

- Segment revenue in the third quarter of 2021 increased by 24 per cent compared to the third quarter of 2020 to €78.6m This growth was driven primarily by uptake in our higher value-add offerings including Managed Betting Services and Live Odds Services, which increased by 63 per cent and 20 per cent respectively, as a result of new customers wins as well as increased turnover2 and volume.

- Segment Adjusted EBITDA* in the third quarter of 2021 increased by 36 per cent compared to the third quarter of 2020 to €44.7m. The Segment Adjusted EBITDA margin* improved from 52 per cent to 57 per cent in the third quarter of 2021 driven by growth in higher margin products.

RoW AV

- Segment revenue increased in the third quarter of 2021 by 13 per cent compared to the third quarter of 2020 to €29.0m. This growth was impacted by COVID related schedule changes in 2020, when more matches than usual were played in Q3 2020. Adjusting for schedule changes Q3 2021 growth was approximately 30 per cent, driven by volume growth as we were able to sell more matches (such as Soccer and Baseball) as well as growth from additional, new content (such as Copa America, Horse Racing and eSports) being sold to existing and new customers.

- Segment Adjusted EBITDA* in the third quarter of 2021 increased by 220 per cent compared to the third quarter of 2020 to €9.6m. The Segment Adjusted EBITDA margin* improved from 12 per cent to 33 per cent in the third quarter of 2021 driven by the lower cost of some content.

United States

- Segment revenue in the third quarter of 2021 increased by 119 per cent compared to the third quarter of 2020 to €19.6m. This result was driven by growth in our US Betting services and increased revenue from our customers as the underlying market and turnover grew. We also experienced strong adoption of our ads product, growth in US Media and a positive impact from the acquisition of Synergy Sports in the second quarter of 2021.

- Segment Adjusted EBITDA* in the third quarter of 2021 increased by 24 per cent compared to the third quarter of 2020 to -€(6.6)m. The Segment Adjusted EBITDA margin* improved from (-60 per cent) to (-34 per cent) in the third quarter of 2021 which reflects the scalability of this business and a clear path to profitability while continuing to invest in the US market.

Costs and Expenses

- Personnel expenses in the third quarter of 2021 increased by €20.0m compared to the third quarter of 2020 to €51.3 million resulting from additional hires in new business lines (2.849 FTE in the third quarter of 2021 vs 2.235 FTE in the third quarter of 2020), stock-based compensation, and reversal of temporary Covid-19 cost savings in the third quarter of 2021 compared to the third quarter of 2020.

- Other Operating expenses in the third quarter of 2021 increased by €15.7m compared to the third quarter of 2020 to €25.2m mainly driven by incurred costs for IPO, compliance costs relating to operating as a publicly listed company in the US and M&A costs.

- Total Sport rights costs in the third quarter of 2021 decreased by €9.0m compared to the third quarter of 2020 to €28.7m resulting from fewer major sporting events in the third quarter of 2021 compared to the third quarter of 2020.

- Adjusted EBITDA* in the third quarter of 2021 was negatively impacted by IPO costs of €5.7m. Eliminating this impact would result in an Adjusted EBITDA* of €26.6m.

Recent Business Highlights

- Issued and sold 19 million shares in connection with the closing of our IPO on Nasdaq raising €546m of primary net proceeds

- Signed integrity partnerships with leading sports leagues and federations such as cricket’s Tamil Nadu Premier League (TNPL), Badminton Europe and the Austrian Tennis Association

- Secured a multi-year exclusive official data and media rights deal with Ligue Nationale de Basket (LNB), France’s top basketball league

- Implemented full Computer Vision models for Grand Slam tennis events including Wimbledon and US open

- Combined newly developed AI tools with our Managed Trading Services, Sportradar’s holistic trading service for sportsbook operators, to more accurately detect potential betting related match-fixing

- Announced partnership extension with US market leader FanDuel Group through 2028

- Announced a five-year deal with US betting and iGaming operator, Bally’s Interactive, to help support and grow sportsbook operations in the US

- Celebrated three wins at the EGR B2B Awards in the Best Customer Service and Live Streaming Supplier categories, as well as the recently acquired Fresh Eight being shortlisted for Best Marketing and PR Supplier

Financial Outlook

For the full-year 2021, the Company currently expects:

- Revenue in the range of €553m to €555m, representing growth of 36.6 per cent to 37.1 per cent for fiscal 2021

- Adjusted EBITDA* in the range of €99.5m to €101.5m, representing growth of 29.4 per cent to 32.0 per cent for fiscal 2021