Kambi Group repurchases shares during 6 May – 10 May 2024

Under the Programme, Kambi is authorised to repurchase a maximum of 3,127,830 ordinary B shares, up to a maximum amount of €4m.

Press release.- Kambi Group has during the period 6 May to 10 May 2024 repurchased a total of 65,000 ordinary B shares (ISIN: MT0000780107) as part of the share buyback programme, within the mandate approved at the Extraordinary General Meeting on 19 June 2023.

The objective of the Programme is to achieve added value for Kambi´s shareholders and to give the Board increased flexibility with Kambi´s capital structure by reducing the capital. The Programme is being carried out in accordance with the Maltese Companies Act, the EU Market Abuse Regulation No 596/2014 (“MAR”), Commission Delegated Regulation (EU) No 2016/1052 (“Safe Harbour Regulation”) and other applicable rules.

During the Buyback Period, Kambi repurchased a total of 65,000 ordinary B shares at a volume-weighted average price of 102.53 SEK. From the beginning of the Programme, which started on 18 March, until and including 10 May 2024, Kambi has repurchased a total of 387,086 ordinary B shares at a volume-weighted average price of 94.49 SEK per share.

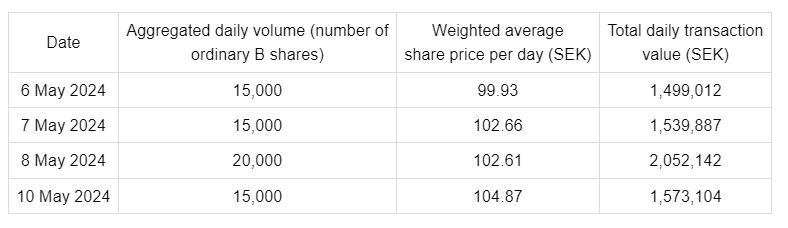

During the Buyback Period, Kambi has repurchased shares as follows:

All acquisitions have been carried out on Nasdaq First North Growth Market in Stockholm by Carnegie Investment Bank AB on behalf of Kambi. Following the acquisitions and as of 10 May 2024, Kambi’s holding of its own shares amounted to 1,282,678 and the total number of issued shares in Kambi is 31,278,297 ordinary B shares. Under the Programme, Kambi is authorised to repurchase a maximum of 3,127,830 ordinary B shares, up to a maximum amount of €4.0 million.

See also: Kambi’s Festival of Sportsbook returns for fourth year