Bally’s Corporation rejects Standard General takeover offer

A special committee of Bally’s board of directors has rejected the $2bn takeover offer from the New York-based investment firm.

US.- The special committee formed by Bally’s Corporation to evaluate New York investment firm Standard General’s offer to acquire the company, has dismissed the $2bn offer. Bally’s said the committee had terminated all consideration of the proposal.

Standard General’s bid, which was submitted on January 25, offered to acquire all of the outstanding shares of Bally’s for $38.00 in cash per share. This would have priced Bally’s as a whole at $2.07bn, which represented a premium of 30 per cent on the closing price on January 24, 2022.

Bally’s, however, has decided that price is too low and that a better proposal may emerge. It’s decided that Bally’s should initiate a cash tender offer for its shares, the offer of which is anticipated to involve $300m to $500m.

CEO Lee Fenton said: “The company has very substantial opportunities before it, including the integration of the Gamesys acquisition, the build-out of Bally’s North American interactive business and the continued strategic expansion of our land-based footprint in the US. With these opportunities in front of us, we have great confidence in the future as we move forward.”

Soo Kim, Standard General’s managing partner and chair of Bally’s, said that the decision to dismiss the deal would not affect how Standard General supports the operator.

He said: “While we are of course disappointed with the outcome of the discussions of our proposal, as we said from the outset, we intend to remain a supportive, long-term investor in the company.”

See also: Bally’s presents environmental, social, and governance strategy

Bally’s new project

Chicago mayor Lori Lightfoot has confirmed that Bally’s Corporation has been selected to build and operate Chicago’s first casino. The announcement came only two days after Lightfoot denied reports that the city had chosen Bally’s proposal as the winning bid.

Bally’s proposal is for a $1.7bn casino to be built on the 30-acre Chicago Tribune Publishing Center at the intersection of Chicago Avenue and Halstead Street. The casino is to have 3,400 slots, 170 table games, 500 hotel rooms, six restaurants, three bars, a 3,000-seat theatre, an outdoor park and other amenities.

The project is expected to create 3,000 construction jobs per year, in addition to 3,000 permanent casino roles when fully functional. Bally’s will pay the city $40m up front plus annual payments of $4m.

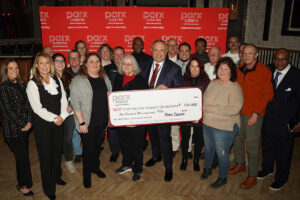

As part of Bally’s Community Investment Program, 25 per cent of the equity in Bally’s Chicago will be reserved for a matched financing scheme that will allow local communities of investors to own a stake in the project.