AGA: US commercial GGR for May up 6% annually

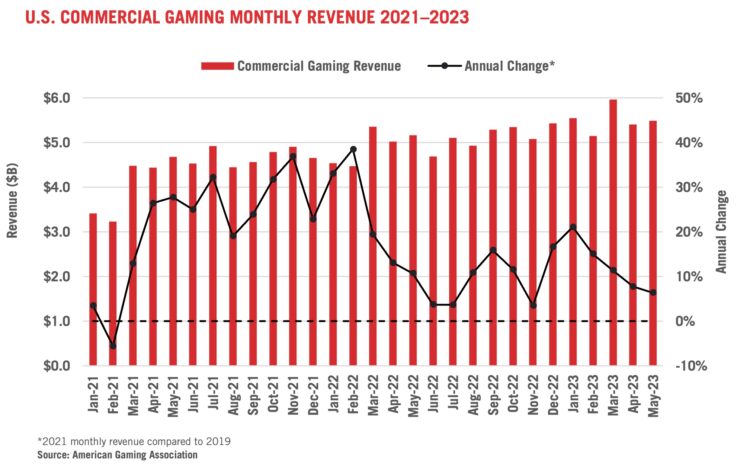

May was the 27th consecutive month of growth in GGR.

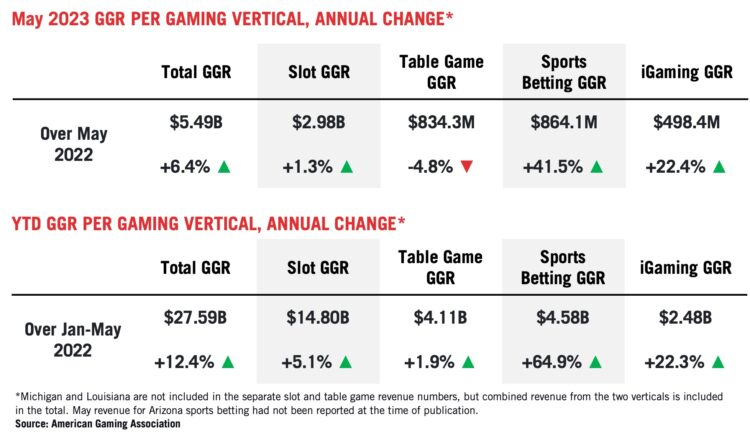

US.- Commercial gaming revenue in the US grew by six per cent annually in May, reaching $5.49 bn, according to state regulatory data compiled by the American Gaming Association (AGA). While this marked the 27th consecutive month of annual national growth, the strength of state market performances have begun to diverge.

Through the first five months of 2023, commercial gaming revenue is tracking 12.4 per cent ahead of last year’s record-setting pace, reaching a total of $27.59 bn through May.

While the annual growth rate remained healthy in May, the pace of revenue acceleration slowed for a fourth consecutive month, reflecting the end of Covid-related impacts on year-over-year growth measures.

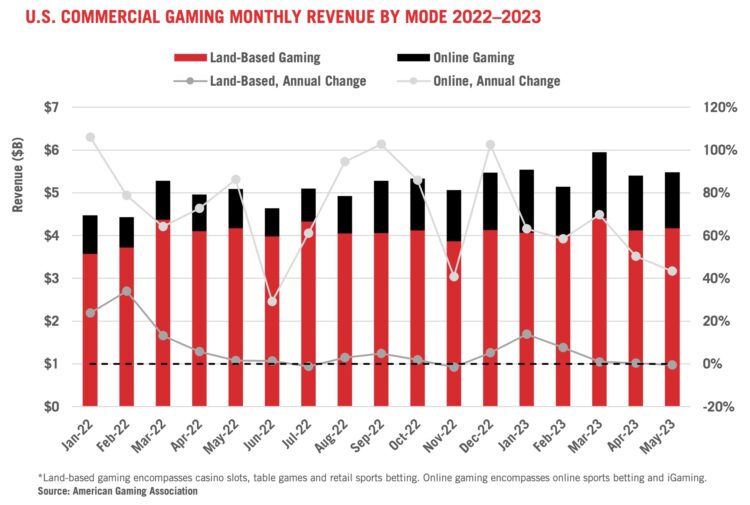

Revenue from land-based gaming, which encompasses casino slots, table games and retail sports betting, declined slightly (-0.6 per cent) compared to the previous year. Conversely, revenue from online gaming grew 43.4 per cent year-over-year. This growth was driven largely by the introduction of online sports betting in Kansas, Maryland, Massachusetts and Ohio within the past year, as well as the continued growth of igaming in the six states where it is legal.

At the state level, 24 out of 33 commercial gaming jurisdictions that were operational last year reported annual revenue gains in May. Nine states – Delaware, Florida, Iowa, Indiana, Louisiana, Missouri, Missouri, Nevada and Oregon – experienced declines in overall revenue, primarily due to slowdowns in the traditional casino segment, and as a result of lower sports betting revenue in Delaware, Mississippi and Oregon.

Although their growth has decelerated nationwide compared to digital offerings, traditional casino slot machines and table games remain the dominant engine of commercial gaming revenue. In May, these segments accumulated a total revenue of $4.12 bn, a decrease of 0.3 per cent compared to the previous year. Slot machines generated $2.98 bn in revenue, up 1.3 per cent, while table game revenue declined 4.8 per cent to $834.3 m. The individual slot and table game figures do not include data from Louisiana and Michigan due to state reporting differences though their aggregates are captured by the combined nationwide figure.

Year-to-date through May, the combined revenue from casino slot machines and table games reached $20.50 bn, surpassing last year’s pace by 4.1 per cent. At the state level, 19 out of 25 commercial gaming states that offered these gaming options in 2022 posted year-to-date revenue growth in these segments through May.

See also: US commercial gaming revenue sets new annual record