GBGC: Japan could boost sports betting industry by expanding regulation

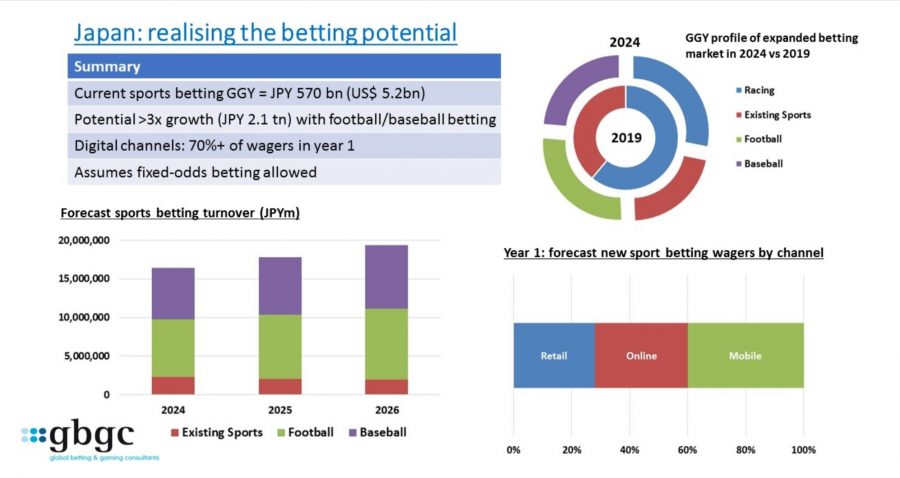

Japan currently only offers three sports betting options. If it includes more sports with a new betting regulation, the market would grow significantly, GBGC says.

Report by Global Betting and Gaming Consultants (GBGC).

Global Betting and Gaming Consultants (GBGC) has released a report about Japan’s sports betting market, which could more than treble its revenues if regulation allowed it to expand beyond the current range of sports.

Away from horseracing, betting is currently only available on three sports: motorboat racing, cycling and motorcycling.

Of these three sports, betting on motorboats is by far the most popular. It accounts for almost 70 per cent of betting revenues in a sector that was worth almost JPY 570 billion (US$5.2 billion).

But the potential revenues of the Japanese sports betting market are so much greater if betting regulation was expanded to include the more popular sports of football (J League) and baseball (NPB).

Over the last year, Japanese sport has seen its income fall because of restrictions to tackle the COVID-19 pandemic, in common with many other countries. On top of that, the Tokyo Summer Olympics were postponed in 2020 and the delay is said to have cost several billion dollars.

Betting tax and a possible sports levy on expanded betting activity would be a welcome source of new income.

The process of regulating casino resorts in Japan, however, does not suggest it will be a quick road to any expansion of sports betting.

But it is noticeable in other jurisdictions that the economic damage done by the COVID-19 pandemic has hastened the pace of regulatory change. It is a factor that might force Japan’s hand too.

In a low-tax, competitive market that allows fixed-odds betting, GBGC estimates the sports betting market could be worth JPY 2.1 trillion (US$ 19.3 billion) in its first year.

Over the first three years, the market could raise JPY 650 billion (US$ 5.9 billion) in betting tax and sports levy.