British Gambling Commission sees slight rise in youth gaming in 2024

The number of young people gambling was up by one percentage point.

UK.- The Gambling Commission (UKGC) has published the statistics from its Young People and Gambling 2024 survey. Conducted by Ipsos, the annual survey seeks to track young people’s involvement in gambling and its impact on them.

This year’s study was based on data from 3,869 pupils aged 11 to 17 in school curriculum years 7 to 12 (S1 to S6 in Scotland) in England, Scotland, and Wales using the Ipsos Young People Omnibus. Pupils completed an online self-report survey in class, while fieldwork was conducted between February and June 2024.

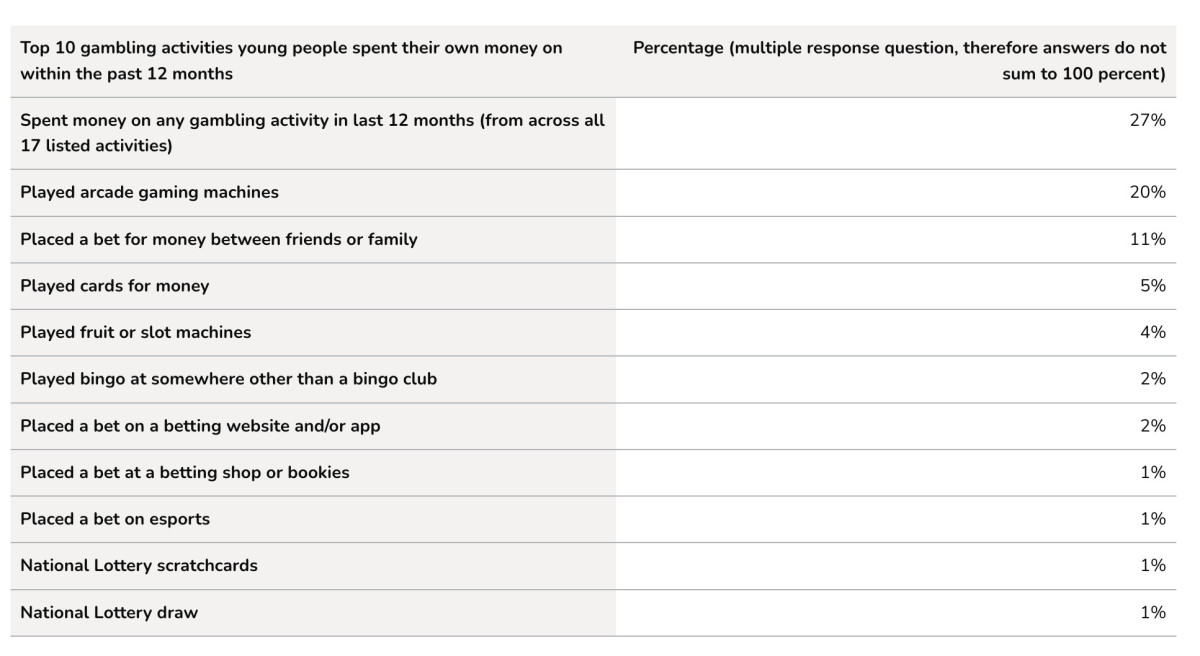

The survey found that 27 per cent of respondents said they had spent their own money on gambling in the prior 12 months. That’s an increase from 26 per cent in 2023. Gaming machines were the most popular form of gambling among those who gambled (20 per cent). This was followed by bets with friends or family (11 per cent) and playing cards for money (5 per cent).

Some 2 per cent of respondents said they had bet on websites or apps and 1 per cent had visited a betting shop. The proportion of respondents buying National Lottery tickets and scratch cards was level year-on-year at 1 per cent of those who gambled.

As for the causes of gambling among young people, family exposure was cited as an influence. As for problem gambling, the youth-adapted DSM-IV-MR-J screen was used as a gauge. Some 1.9 per cent scored 2 or 3, which is considered ‘at risk’, and 1.5 per cent scored 4 or more, which is indicative of problem gambling. Boys aged 14–17-year-olds were found to be most likely to score 4 or more.

While the study found only a 1-point increase in gambling participation, it found a more notable rise in gambling-related behaviours. The proportion of respondents who reported thinking about or planning to gamble rose from 3 to 7 per cent, and the proportion needing more money to feel excitement rose from 2 to 4 per cent, those who said they took money without permission for gambling rose from 6 to 11 per cent and those who lied about gambling rose from 1 to 3 per cent.

Some 6 per cent reported that gambling interfered with their studies and 2 per cent reported losing sleep.

Earlier this week, the Money and Mental Health Policy Institute (MMHPI), a charity established by MoneySavingExpert founder Martin Lewis, proposed that UK banks should play a greater role in tackling gambling harm. Its new policy paper says financial institutions could help fill gaps in support.

The paper examines gambling harms in Britain and the role of current account providers. It notes that banks and financial institutions have “unique visibility” of their customers’ spending habits, which could enable them to identify and intervene in cases of potentially harmful gambling behaviour. The charity suggests this could help in cases where customers hide their problems due to stigma.