Aspire Global shares interim report Fourth Quarter 2021

Financial report shows record high revenues of EUR 213m in 2021. CEO Tsachi Maimon analysed the results.

Press release.- Aspire Global, the leading B2B provider of iGaming solutions, presented its financial report from Fourth Quarter 2021 and from the full year, where it shows record-high revenues of EUR 213m. See the complete report from the company performance.

Fourth Quarter*

- Revenues increased by 14.7 per cent to €50.9 million (44.4).

- Revenues Pro-Forma basis increased by 24.0 per cent to €42.6 million (34.4).

- EBITDA decreased by 9.1 per cent to €7.5 million (8.3).

- EBITDA Pro-Forma basis increased by 24.0 per cent to €7.7 million (6.2).

- The EBITDA margin amounted to 14.8 per cent (18.6 per cent).

- EBITDA margin Pro-Forma basis amounted to 18.1 per cent (18.1 per cent)

- EBIT decreased by 18.7 per cent to €5.1 million (6.3).

- EBIT Pro-Forma basis increased by 25.1 per cent to €5.3 million (4.3).

- Earnings after tax (before €59.7 million net capital gain on B2C divestment) increased by 38.9 per cent to €4.2 million (3.1).

- Earnings per share amounted to €0.09 (0.07) and €1.37 incl. capital gain from divestment of the B2C segment.

Full Year*

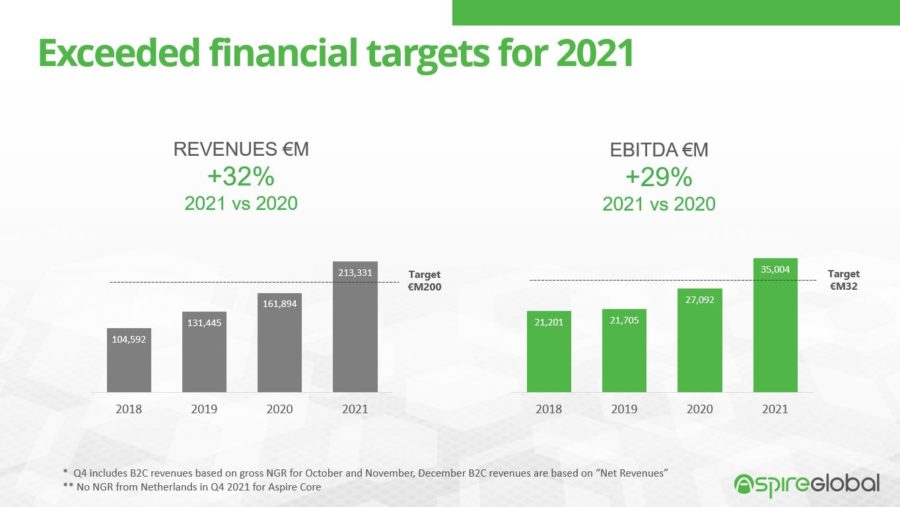

- Revenues increased by 31.8 per cent to €213.3 million (161.9).

- Revenues Pro-Forma basis increased by 31.9 per cent to €166.5 million (126.2).

- EBITDA increased by 29.2 per cent to €35.0 million (27.1).

- EBITDA Pro-Forma basis increased by 45.2 per cent to €30.4 million (20.9).

- The EBITDA margin amounted to 16.4 per cent (16.7 per cent).

- EBITDA margin Pro-Forma basis amounted to 18.2 per cent (16.6 per cent)

- EBIT increased by 26.2 per cent to €26.3 million (20.8).

- EBIT Pro-Forma basis increased by 47.7 per cent to €21.6 million (14.7).

- Earnings after tax (before €59.7 million net capital gain on B2C divestment) increased 72.0 per cent to €22.6 million (13.1).

- Earnings per share increased 64.3 per cent to €0.49 (0.28) and €1.77 incl. capital gain from divestment of B2C segment.

*B2C as continued operations and based on net royalties in December 2021. Pro-Forma basis of B2C based on net royalties for the presented period and a specification is found on page 8 in the report.

Significant events in the Quarter

- Aspire Global divested its B2C segment effective on 1 December, 2021.

- Further expansion in the US by Pariplay’s deal with BetMGM, the leading US online casino operator.

- Strengthened position in Latin America through BtoBet’s deal with FanDuel, part of Flutter Entertainment, to provide its PAM for Daily Fantasy Sports in Brazil. Pariplay signed deal to supply its proprietary games to Holland Casino in the Netherlands. BtoBet signed deal with BestBet24 to provide its sports platform in Poland.

- Agreement to acquire 25 per cent of bingo supplier END 2 END with option to acquire all shares.

- The Board of Directors proposes that no dividend is paid for the financial year 2021.

Significant events after the end of the Quarter

- On 17 January 2022, a public tender offer was made by NeoGames to the shareholders of Aspire Global to tender all their shares in the Company to NeoGames for a consideration consisting of a combination of cash and newly issued shares in NeoGames in the form of Swedish depository receipts. The shares in NeoGames are admitted to trading in the US on the Nasdaq Stock Exchange, Global Market tier.

- Aspire Global’s main shareholders, who in aggregate own shares corresponding to 66.96 per cent of all shares and votes in Aspire Global, have entered into irrevocable undertakings that enable the other shareholders in Aspire Global to tender their shares to NeoGames and receive 100 per cent cash consideration corresponding to SEK 111.00 per share tendered in Aspire Global representing a premium of 41.40 per cent compared to the closing price 17 January 2022 of SEK 78.50 for Aspire Global’s share. The Bid Committee of Aspire Global unanimously recommends the shareholders of Aspire Global to accept the full cash consideration alternative of SEK 111.00 per Aspire Global share.

CEO Tsachi Maimon comments on the results

“We have successfully delivered on our own strategy and exceeded our financial targets.

“Aspire Global has made an amazing journey in recent years with substantial organic growth supplemented by value-creating acquisitions. NeoGames’ bid of SEK 111 per share means that our share has increased by 270 per cent since the introduction on Nasdaq First North Growth Market in July 2017. The offer by NeoGames, a technology-driven provider of end-to-end iLottery solutions, is a natural step for Aspire Global and a strategic fit.

“Aspire Global’s entire operations will form a new iGaming division within NeoGames. The objective of the combination is to generate significant long-term value for both sets of shareholders, by creating synergies and capitalizing on the key strengths of our two companies and positioning them both for expansion in new and existing markets.

“We believe that the irrevocable commitment by a significant portion of our shareholders to elect to receive the entirety of the equity component of the deal, subject to proration, suggests strong conviction in the future of the two companies. Not only is this a strategic fit, but it is also a strong cultural fit, as significant parts of both management teams worked together extensively during NeoGames’ inception.”

RECORD HIGH B2B PERFORMANCE

“By the divestment of our B2C segment on 1 December 2021, we made an additional significant strategic move to become a clearly focused B2B company. By this streamlining of the business, we not only become stronger but also more profitable. During the year, excluding the B2C segment, revenues increased by 31.5 per cent to €158.3 million and EBITDA increased by 45.2 per cent to €30.4 million in 2021 with an EBITDA margin of 19.2 per cent. B2B organic revenue growth in 2021 amounted to 26.6 per cent.

“These are record high numbers that we are proud of and they reflect the professionalism, drive and commitment of the Aspire Global team. It is also with satisfaction that I can note that we have well exceeded our financial targets for 2021.

“We had a strong development during all quarters in 2021 and revenues, excluding B2C, increased 24.4 per cent in Q4. The numbers in Q4 2021 were impacted negatively by new regulations in certain European countries as well as unusually favourable player results in Sports during October, while the inclusion of the divested B2C brands on a “net royalties” basis in December 2021 had a positive impact.”

GERMAN AND DUTCH PLATFORM DEALS

“We have recently made significant progress in the execution of our growth strategy by adding new tier 1-operators to our customer base and entering new regulated markets. Our turnkey platform deals with ITPS for Germany and BoyleSports for the Netherlands clearly shows the recognition we have in supplying our platform in regulated markets to tier 1-operators. Both Germany and the Netherlands are expected to become very big iGaming markets with large growth potential.

“At the end of 2021, we completed the migration of all major partner brands to BtoBet’s proprietary sportsbook platform and we could phase out our previous third-party supplier. The rapid execution of the migration is important proof of Aspire Global’s strong technological, managerial and operational skills.

PARIPLAY – KEY PROGRESS IN NORTH AMERICA

“Pariplay, the leading content and aggregator provider, shows over and over again its strengths by delivering successfully on its growth strategy. By striking important deals in North America, we are on our way to establishing ourselves as a key iGaming supplier in this fast-growing market.

“Pariplay is now certified in Michigan, New Jersey and West Virginia and has signed deals for all three states with leading US operator Golden Nugget Online Gaming and the top-three US online casino operator BetMGM. Through the collaboration with NeoPollard Interactive, Pariplay will enter the Canadian market after signing a deal to offer its content on Play Alberta, the province’s only regulated online gambling site.

“In Q4 2021, Pariplay extended its successful partnership with Rush Street Interactive (RSI) and launched its proprietary games with RSI in Colombia. Pariplay also signed a deal to supply its proprietary games to Holland Casino, the biggest Dutch operator.”

BTOBET STRIKES FURTHER DEAL WITH FLUTTER

“BtoBet, our proprietary sportsbook, has recently been awarded certification in Denmark and the Netherlands. After having received Dutch certification for not only the sportsbook and games but also the platform, we will now provide our complete offering in the Netherlands. In Denmark, we add sports to our present casino offering.

“In Q4 2021, BtoBet entered Poland by a deal with Warsaw-based BestBet24. BtoBet will provide BestBet24 its sportsbook platform for both retail and online channels. BtoBet has also extended its collaboration with Flutter Entertainment by providing FanDuel its cutting-edge PAM platform as the operator enters the Brazilian market with its Daily Fantasy Sports (DFS) offering.”

ENHANCING OFFERING WITH BINGO

“In December 2021, we took an important step in our strategy to control the entire B2B value chain by acquiring a minority share of the bingo supplier END 2 END with an option to acquire all the shares. END 2 END and its certified bingo product provide us with access to real omnichannel technology and a proprietary offering in one of the biggest verticals in the iGaming industry.

“Bingo is especially important in regulated markets where operators request the opportunity to offer more than one vertical. We are very satisfied with END 2 END’s performance and the opportunities we have identified so far.”

THE AMAZING ASPIRE GLOBAL TEAM

“During 2021, we increased investments in the further development of our team’s skills by introducing an advanced leadership program. It will be exciting to follow the development of our leaders and how the program can contribute to even higher motivation and creativity.

“I would like to take this opportunity to thank everyone on the Aspire Global team for their fantastic efforts in 2021. It is also good that we will keep the relationship with our great Karamba team, who constituted the B2C segment, as they continue as one of our major partners.”

OUTLOOK

“Aspire Global is today a focused B2B company with a leading offering in the iGaming industry. We have over the past years made significant progress in building a strong position and adding tier 1-operators to our partner base, not at least after the value-creating acquisitions of BtoBet and Pariplay. We are now looking forward to the next step in our journey and I am very excited by the opportunities the combination of Aspire Global and NeoGames offers.”