AGA reports commercial gaming revenue of $17.71bn in Q3

The industry contributed more than $3.7bn in gaming tax revenue.

US.- The American Gaming Association (AGA) has reported that commercial gaming revenue in the US reached $17.71bn in the third quarter of the year. It was the industry’s highest-grossing Q3 on record, according to AGA’s Commercial Gaming Revenue Tracker, and the 15th consecutive quarter of annual revenue growth. September was the 43rd straight month of growth.

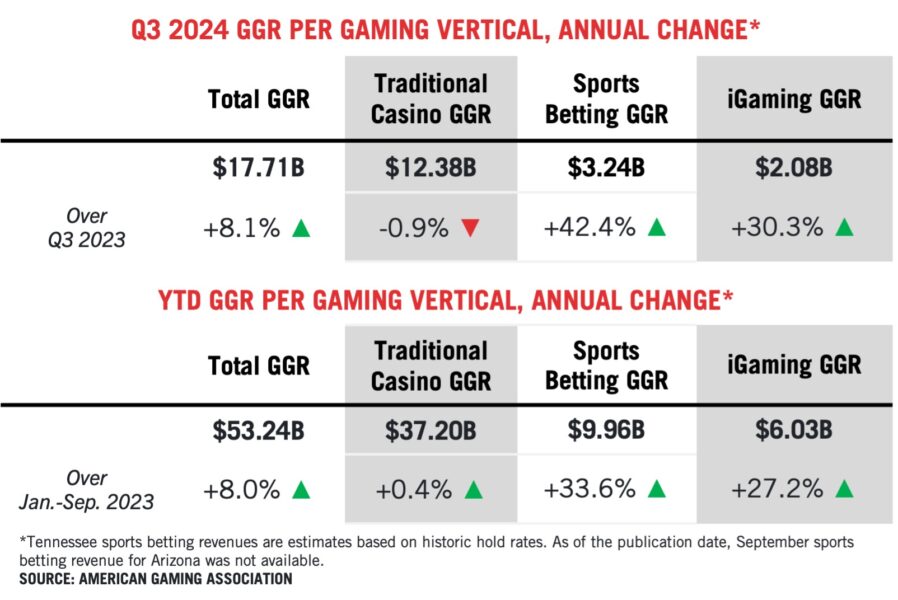

For the first nine months of the year, nationwide commercial gaming revenue stands at $53.24bn, 8 per cent ahead of 2023.

In Q3 2024, 29 of the 35 commercial gaming jurisdictions operational last year saw increased year-over-year revenue. This growth resulted in an 8.9 per cent year-over-year increase in state and local taxes tied directly to gaming revenue, with commercial gaming operators contributing $3.79bn in taxes across the quarter.

Quarterly revenue from land-based gaming – encompassing casino slots, table games and retail sports betting – totalled $12.56bn, 0.62 per cent lower than Q3 2023. Meanwhile, combined revenue from online sports betting and iGaming totalled $5.14bn in Q3 2024 as online gaming made up 29.0 per cent of commercial gaming revenue, a significantly higher share than in Q3 2023.

See also: AGA study: industry investments in responsible gaming reach new high of $472m annually

Revenue by sector

- Traditional gaming: Traditional brick-and-mortar casino gaming generated quarterly revenue of $12.38bn, a contraction of 0.9 per cent year-over-year.

- Legal sports betting: Americans legally wagered $30.3bn on sports, generating $3.24bn in quarterly revenue (+42.4 per cent YoY). Recent market launches in Kentucky, Maine, North Carolina and Vermont contributed to this growth.

- iGaming: iGaming generated $2.08bn in revenue, marking a 30.3 per cent year-over-year increase.

“Q3 2024 continued gaming’s momentum from the first half of the year, with online casino and sports betting driving strong growth. At the same time, new brick-and-mortar casino openings bolstered traditional gaming, which still accounts for the bulk of industry revenue,” said AGA vice president of Research David Forman. “More than a quarter of commercial revenue now regularly comes from online sources, raising the importance of continued sustainable growth with consumers in those states.”