Kambi Group repurchase of shares during 26 February 2024 – 1 March 2024

The company repurchased a total of 50,000 shares as part of the share buyback programme.

Press release.- Kambi Group has during the period 26 February 2024 to 1 March 2024 repurchased a total of 50,000 shares as part of the share buyback programme at a volume-weighted average price of 103.46 SEK, within the mandate approved at the Extraordinary General Meeting on 19 June 2023.

The objective of the buyback is to achieve added value for Kambi´s shareholders and to give the Board increased flexibility with Kambi´s capital structure. The programme was carried out in accordance with the Maltese Companies Act and other applicable rules.

From the programme start on 5 December 2023 until and including 1 March 2024, Kambi has repurchased a total of 174,600 shares at a volume-weighted average price of 143.46 SEK per share.

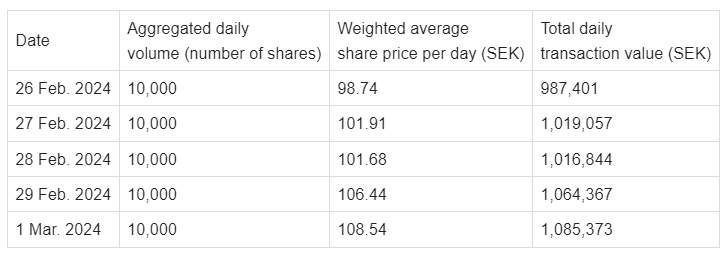

During the period 26 February 2024 until 1 March 2024, shares in Kambi have been repurchased as follows:

All acquisitions have been carried out on Nasdaq First North Growth Market in Stockholm by Carnegie Investment Bank AB on behalf of Kambi. Following the acquisitions and as of 1 March 2024, Kambi’s holding of its own shares amounted to 832,592 and the total number of issued shares in Kambi is 31,278,297. In total, a maximum of 3,127,830 shares may be repurchased to a maximum amount of €2.8 million.